Unraveling the Mysteries of Bitcoin Mining – What It Is and How It Works

What is Bitcoin mining? In simple terms, Bitcoin mining refers to the process through which new bitcoins are created and transactions are verified on the Bitcoin network. This intricate process plays a crucial role in maintaining the integrity of the blockchain and allowing decentralized financial exchanges to flourish. In this comprehensive guide, we will delve deep into the world of Bitcoin mining, covering its mechanics, significance, challenges, and future prospects.

Understanding Bitcoin Mining: An Introduction

Bitcoin mining is a fundamental aspect of the cryptocurrency ecosystem that combines computer science, economics, and network security. At its core, it involves solving complex mathematical problems to validate transactions and add them to the public ledger known as the blockchain. The miners who participate in this process are rewarded with newly minted bitcoins, thus incentivizing their efforts.

In recent years, Bitcoin mining has evolved from a hobbyist activity conducted by individual enthusiasts using personal computers to a highly competitive industry dominated by large-scale operations. This transition can be attributed to the growing demand for Bitcoin and the increasing complexity of the mining process itself.

The Birth of Bitcoin

The concept of Bitcoin was introduced in 2008 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. The first block of the Bitcoin blockchain, known as the Genesis Block, was mined in January 2009. Since then, Bitcoin has gained popularity, attracting investors, businesses, and individuals around the globe.

With its decentralized nature and limited supply (capped at 21 million coins), Bitcoin presents an alternative to traditional fiat currencies. However, the mechanism behind its creation and the validation of transactions relies heavily on mining.

Why Mining Matters

Mining is essential for several reasons:

- Transaction Verification: Miners validate transactions to ensure that they are legitimate and comply with the rules of the Bitcoin protocol. This process prevents double-spending and ensures that no fraudulent or invalid transactions occur.

- Network Security: By requiring miners to solve complex puzzles, the Bitcoin network becomes resistant to attacks. To alter any information on the blockchain, an attacker would need to control more than 50% of the network’s mining power, which is economically unfeasible.

- Distribution of New Bitcoins: Bitcoin mining is the only method through which new bitcoins are generated and distributed. With the gradual halving of rewards that occurs approximately every four years, mining ensures a controlled release of coins into circulation.

Key Terms to Know

Before delving deeper into the intricacies of Bitcoin mining, it’s important to familiarize yourself with some key terms:

- Blockchain: A decentralized digital ledger that records all transactions across the Bitcoin network.

- Hash Rate: The rate at which a miner can compute hashes (cryptographic functions) to find a valid block. It is usually measured in hashes per second (H/s).

- Proof of Work: The consensus mechanism used by Bitcoin, which requires miners to demonstrate computational effort when validating transactions and adding blocks to the blockchain.

Understanding these foundational concepts will enhance your comprehension of the Bitcoin mining process and its significance within the broader cryptocurrency landscape.

The Mechanics of Bitcoin Mining: How it Works

The mechanics of Bitcoin mining involve a series of steps that combine cutting-edge technology and cryptographic principles. These steps highlight how miners contribute to the network while ensuring the safety and legitimacy of transactions.

When a transaction occurs, it is broadcasted to the entire network, where it awaits validation. Miners compete to solve complex mathematical puzzles through a process called hashing. The first miner to successfully solve the puzzle gets to add the transaction to the blockchain and is rewarded with a fixed number of newly created bitcoins as well as transaction fees.

The Blockchain Structure

The blockchain acts as the backbone of the Bitcoin network. It consists of blocks linked together in chronological order, forming a chain. Each block contains several key components:

- Header: Contains metadata about the block, including the previous block’s hash, a timestamp, and a nonce (a random number used in the mining process).

- Transactions: Each block holds a list of validated transactions that have occurred since the last block was added.

- Merkle Tree: A data structure used to efficiently summarize and verify the integrity of transactions within a block.

This structured format ensures that once information is recorded on the blockchain, it becomes immutable and tamper-proof.

The Mining Process

The mining process includes several critical steps:

- Transaction Transmission: When a user initiates a transaction, details such as the sender’s and receiver’s addresses and the amount are sent to the Bitcoin network.

- Transaction Pool: Valid transactions are collected in a pool known as the mempool, where miners can select which transactions to include in the next block.

- Puzzle Solving: Miners compete to solve the cryptographic puzzle associated with the block header. This involves finding a nonce value that, when hashed with the other block header information, produces a hash starting with a specific number of leading zeros.

- Block Creation: Once a miner solves the puzzle, they broadcast the newly created block to the network. Other miners and nodes verify the validity of the block and the included transactions.

- Reward Distribution: If the block is accepted, the miner receives a reward in the form of newly minted bitcoins and any transaction fees associated with the transactions in the block.

Difficulty Adjustment

The Bitcoin protocol incorporates a difficulty adjustment mechanism to ensure that blocks are mined at a consistent rate, targeting an average time of ten minutes per block. Approximately every two weeks, the network evaluates the total computational power of the network and adjusts the difficulty of the puzzle accordingly. This dynamic system balances the speed of block creation and prevents inflation caused by rapid mining.

Through this detailed understanding of the mechanics involved in Bitcoin mining, it becomes clear how the process not only creates new bitcoins but also maintains the network’s integrity and security.

The Role of Miners in the Bitcoin Network

Miners play a pivotal role in the Bitcoin network, serving as validators, security providers, and economic participants. Their contributions extend beyond just the mining of new blocks; they facilitate the overall functioning of the network and ensure its resilience against malpractices.

Transaction Validators

At the heart of Bitcoin mining lies the responsibility of transaction validation. Miners scrutinize each transaction by ensuring that the funds being transferred are available and that the signatures are correct. These validations prevent issues such as double spending and guarantee that only legitimate transactions are recorded on the blockchain.

Without miners, the Bitcoin network would lack trust and reliability, as there would be no means to confirm the authenticity of transactions. As independent entities, miners provide a decentralized verification process, eliminating the need for intermediaries like banks or payment processors.

Securing the Network

Miners also play a crucial role in securing the Bitcoin network against potential attacks. The competitive nature of mining deters malicious actors who might attempt to manipulate the blockchain. Given the substantial investment required to gain control of over 50% of the total mining power, the network remains largely secure.

Moreover, the requirement of proof of work ensures that miners must expend significant computational resources to contribute to the network. This expenditure makes attacks impractical, as the costs of executing such actions would far outweigh any potential financial gain.

Economic Incentives

The economic model of Bitcoin mining revolves around incentives that encourage miners to participate in the network. Miners receive:

- Block Rewards: For each block they successfully mine, miners receive a set number of newly issued bitcoins. This reward halves approximately every four years during events known as “halvings.”

- Transaction Fees: In addition to block rewards, miners earn transaction fees collected from users who initiate transactions. These fees vary based on network demand and priority specified by senders.

As the supply of bitcoins approaches its cap of 21 million, transaction fees will become increasingly important in sustaining miner profitability. The interplay between block rewards and transaction fees will shape the future of mining economics.

Bitcoin Mining Hardware and Software: A Technical Overview

Bitcoin mining requires specialized hardware and software designed to optimize hashing capabilities and improve overall efficiency. As competition intensifies and the mining difficulty increases, the selection of appropriate equipment becomes paramount for miners seeking profitability.

Mining Hardware Overview

In the early days of Bitcoin, miners could successfully mine using regular CPUs found in personal computers. However, as the network grew and the puzzles became more complex, dedicated hardware emerged to meet the demand for increased hashing power.

- ASIC Miners: Application-Specific Integrated Circuits (ASICs) are the gold standard for Bitcoin mining today. These devices are purpose-built to perform the hashing algorithm used in Bitcoin mining, making them significantly faster and more energy-efficient than general-purpose hardware.

- GPU Miners: Graphics Processing Units (GPUs) were once popular among miners due to their versatility and ability to handle parallel processing tasks. While still used for mining altcoins, GPUs have become less effective for Bitcoin mining due to ASIC dominance.

- FPGA Miners: Field Programmable Gate Arrays (FPGAs) offer a middle ground between GPUs and ASICs. They can be customized for specific tasks, allowing for greater flexibility compared to ASICs, though they may not achieve the same level of performance.

Mining Software

In addition to hardware, miners require specialized software to facilitate the mining process. Mining software connects miners to the Bitcoin network, manages the mining hardware, and helps optimize performance.

Key features of mining software include:

- Pool Support: Many miners join mining pools to increase their chances of earning rewards. Mining software should support easy connection to various pools and allow the distribution of rewards based on contributions.

- Monitoring Tools: Effective mining software provides monitoring tools that track hash rates, temperatures, and power consumption. This information enables miners to adjust settings for optimal performance and efficiency.

- Configurable Settings: Advanced miners often seek software that allows customization of parameters such as overclocking settings, fan speeds, and voltage adjustments to maximize hashing performance.

Choosing the right combination of hardware and software is essential for miners aiming to strike a balance between performance, cost, and energy consumption.

Energy Consumption and Efficiency

One of the major concerns surrounding Bitcoin mining is its energy consumption. As mining operations scale and become more competitive, the demand for electricity increases correspondingly.

Efforts to address this issue include:

- Renewable Energy Sources: Many mining facilities are now utilizing renewable energy sources, such as solar or wind power, to reduce their carbon footprint and lower operational costs.

- Energy-Efficient Mining Operations: Miners are continuously seeking ways to optimize their operations to consume less energy while maximizing output. This includes deploying advanced cooling systems and selecting locations with access to cheap and sustainable energy.

By understanding the technical aspects of Bitcoin mining hardware and software, aspiring miners can navigate the complexities of the industry and make informed decisions that align with their goals.

The Economics of Bitcoin Mining: Profitability and Cost Factors

The economics of Bitcoin mining is a multifaceted subject influenced by various factors that determine whether mining can be a profitable endeavor. As the market landscape continues to evolve, miners must remain vigilant and adaptable to changing conditions.

Revenue Generation

Revenue from Bitcoin mining primarily stems from two sources: block rewards and transaction fees.

- Block Rewards: Initially set at 50 BTC per block, the block reward has undergone several halvings, reducing it to 6.25 BTC as of the latest event in May 2020. Future halvings will further decrease this reward, impacting miners’ revenue streams.

- Transaction Fees: Miners are also compensated through transaction fees paid by users who want their transactions expedited. The fee structure is influenced by network congestion, with higher demand resulting in increased fees. This dynamic creates opportunities for miners to generate additional income, especially during periods of high transaction volumes.

Operating Costs

While revenue generation is essential, miners must also consider their operating costs to assess profitability accurately.

- Electricity Costs: Energy consumption is often the largest expense for miners, accounting for a significant portion of operational costs. Miners should seek locations with competitively priced electricity to maintain profitability.

- Hardware Investment: Investing in mining hardware involves considerable upfront costs. As technology progresses, miners must regularly upgrade their equipment to remain competitive, which adds another layer of financial consideration.

- Cooling and Maintenance: Mining rigs generate substantial heat, requiring cooling solutions to maintain optimal operation. The expenses associated with cooling systems and routine maintenance should be factored into overall costs.

Market Volatility

The cryptocurrency market is notoriously volatile, with prices fluctuating dramatically over short periods. These fluctuations can significantly impact miners’ revenues and profitability.

- Price of Bitcoin: When Bitcoin prices rise, mining becomes more lucrative, as the value of rewards increases. Conversely, during bearish market conditions, reduced revenues may result in non-profitable mining operations.

- Difficulty Adjustments: The mining difficulty adjusts roughly every two weeks based on the total hash rate of the network. As more miners enter the space, difficulty increases, which can reduce individual miners’ earnings if they do not adapt.

Breaking Even

Determining the break-even point for mining operations involves a careful analysis of both revenue and costs. Miners must calculate their expected earnings based on current Bitcoin prices, anticipated transaction fees, and the prevailing difficulty level.

Sample Data Table

| Factor | Description |

|---|---|

| Block Reward | 6.25 BTC (as of May 2020) |

| Avg. Electricity Cost | $0.05 per kWh |

| Mining Rig Cost | Varies (up to $10,000 for high-performance ASICs) |

| Hash Rate Needed | Depends on current difficulty |

By examining these factors collectively, miners can gauge their potential profitability and make informed decisions regarding their operations.

The Future of Bitcoin Mining: Challenges and Innovations

As the cryptocurrency landscape continues to expand, Bitcoin mining faces an array of challenges while simultaneously fostering innovations to adapt to evolving circumstances. This section explores the key hurdles and advancements shaping the future of Bitcoin mining.

Environmental Concerns

One of the most pressing challenges facing Bitcoin mining is its environmental impact. Critics argue that the energy-intensive nature of mining contributes to greenhouse gas emissions and climate change. Addressing these concerns is vital for the sustainability of the industry.

- Transition to Renewable Energy: An increasing number of mining operations are turning to renewable energy sources, driven by both ethical considerations and economic incentives. Harnessing solar, wind, and hydroelectric power can help mitigate environmental impacts while reducing operational costs.

- Carbon Offsetting Initiatives: Some mining companies are investing in carbon offsetting initiatives to counterbalance their emissions. These efforts aim to promote environmental stewardship and bolster the perception of Bitcoin mining as a sustainable industry.

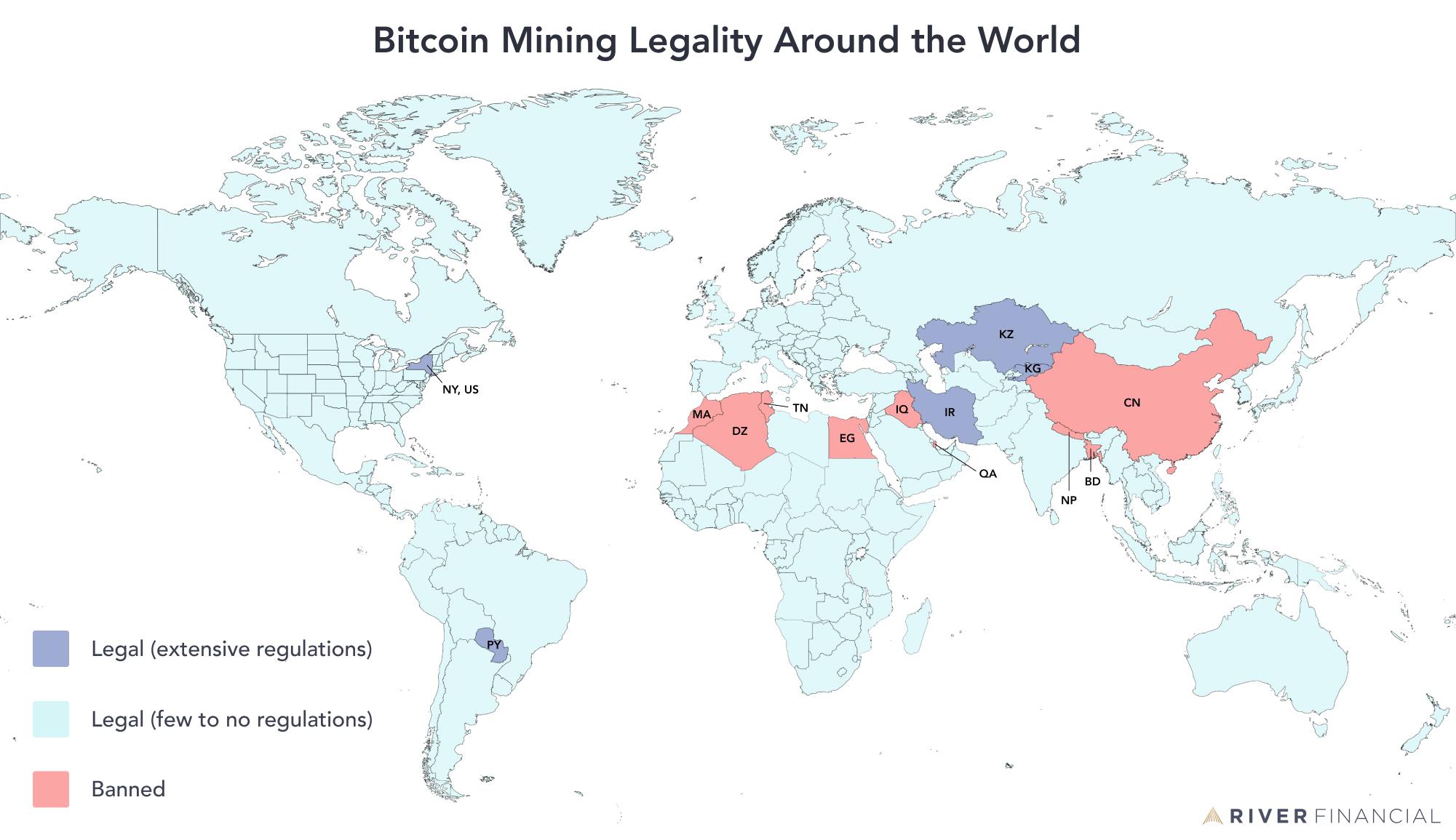

Regulatory Landscape

As governments worldwide grapple with the implications of cryptocurrencies, regulatory frameworks are emerging to govern mining activities. The approach to regulation varies widely by jurisdiction, creating uncertainty and variability in the industry.

- Licensing Requirements: In some regions, miners may face licensing requirements, taxation, or restrictions on energy usage. These regulations can affect operational viability and influence mining location choices.

- International Cooperation: As the global nature of Bitcoin mining becomes more pronounced, international cooperation on regulatory standards may develop. Harmonizing regulations can help create a more stable environment for miners.

Technological Advancements

Innovation in technology plays a crucial role in shaping the future of Bitcoin mining. As competition intensifies, miners are continually seeking advancements that enhance efficiency and profitability.

- Improved Hardware Designs: The development of next-generation ASIC miners promises increased hashing capabilities alongside reduced energy consumption. Manufacturers are constantly striving to push the envelope of what is achievable in mining technologies.

- Emerging Protocols: New consensus protocols, such as proof-of-stake, are being explored as alternatives to proof of work. While proof-of-stake is not currently applicable to Bitcoin, ongoing research and experimentation may yield improvements in efficiency and security for future cryptocurrency networks.

The Evolution of Mining Pools

Mining pools have become an integral component of the Bitcoin mining landscape, enabling miners to collaborate and share resources. The evolution of mining pools presents both opportunities and challenges.

- Decentralized Mining Pools: The rise of decentralized mining pools aims to increase fairness and transparency in the distribution of rewards. By eliminating centralization, participants can benefit from a more equitable system.

- Integration of Artificial Intelligence: Emerging technologies like artificial intelligence are being explored to optimize mining operations. Predictive analytics can aid miners in making informed decisions regarding timing, resource allocation, and energy use.

As we peer into the future of Bitcoin mining, it is evident that addressing environmental concerns, navigating regulatory landscapes, and embracing technological advancements will be essential for the industry’s continued growth and success.

Conclusion

In summary, what is Bitcoin mining? It is a complex yet fascinating process that underpins the Bitcoin network, serving multiple functions, from transaction validation to network security. By exploring the mechanics, roles, economics, and future challenges of Bitcoin mining, we gain valuable insights into this dynamic aspect of the cryptocurrency ecosystem. Miners, as custodians of the Bitcoin blockchain, stand at the intersection of innovation and tradition, navigating an ever-changing landscape as they contribute to the future of finance.