Understanding What is Blockchain in Bitcoin – Unraveling the Core Technology Behind Cryptocurrency

What is blockchain in Bitcoin? This question often arises in discussions surrounding cryptocurrency, particularly as it pertains to the innovative digital currency known as Bitcoin. To understand the significance of blockchain technology in Bitcoin, one must delve into its foundational role, its structure, its operation, and how it underpins the very existence of Bitcoin itself.

Blockchain Technology: A Foundation for Bitcoin

Blockchain technology serves as the backbone of Bitcoin, fundamentally altering the way we perceive transactions and trust in a digital economy. It is a decentralized ledger that records all transactions across numerous computers in a way that ensures security, transparency, and immutability.

In essence, a blockchain is a distributed database or ledger that is shared among the nodes of a computer network. As the name implies, data is stored in “blocks,” which are linked to form a “chain.” Each block contains a collection of transactions, along with a timestamp and a unique cryptographic hash of the previous block, creating a secure and chronological chain of information.

The Historical Context of Blockchain Technology

To appreciate the emergence of blockchain technology within the realm of Bitcoin, it is important to understand the historical context from which it arose. The concept was first introduced in 1991 by Stuart Haber and W. Scott Stornetta, who outlined a system for time-stamping digital documents to prevent backdating or tampering.

However, it wasn’t until 2008 that the modern incarnation of blockchain emerged with the publication of a whitepaper by an individual (or group) under the pseudonym Satoshi Nakamoto. This document detailed the workings of Bitcoin and proposed a peer-to-peer electronic cash system that would utilize blockchain technology to eliminate the need for intermediaries in financial transactions.

The introduction of blockchain alongside Bitcoin marked a paradigm shift not only in finance but also in various industries. It laid the groundwork for the development of thousands of cryptocurrencies and decentralized applications, extending far beyond mere monetary transactions.

How Blockchain Transforms Trust and Transactions

Before the advent of blockchain, traditional systems relied heavily on centralized entities—such as banks or payment processors—to mediate trust and process transactions. This reliance created vulnerabilities. For example, centralized databases can be hacked, manipulated, or mismanaged, resulting in loss of funds and trust.

Blockchain technology revolutionized this by distributing control across a network of computers, mitigating the risk of single points of failure. Each participant in the network holds a copy of the complete ledger, making it nearly impossible to alter past transactions without the consensus of the majority. This decentralized consensus mechanism fosters trust among users, enabling them to engage in peer-to-peer transactions confidently.

Moreover, blockchain’s use of cryptographic techniques ensures that once information is recorded, it cannot be changed without the alteration being evident. This feature is crucial for maintaining the integrity of Bitcoin transactions.

Bitcoin’s Blockchain: Structure and Functionality

Bitcoin’s blockchain is a specific implementation of blockchain technology tailored to facilitate Bitcoin transactions. Understanding its structure and functionality requires analyzing how blocks are organized, how they communicate, and how information flows through the network.

The Anatomy of a Bitcoin Block

Each Bitcoin block serves as a container for transaction data. When a new block is created, it comprises several key elements:

- Block Header: This contains metadata about the block, including the previous block’s hash, a timestamp, and the nonce (a number used once to find a valid hash).

- Transaction Counter: A count of the number of transactions included in the block.

- Merkle Root: A hash that represents all transactions contained within the block, providing a condensed summary of the data for quick verification.

These elements work together to create a cohesive unit that accurately represents a snapshot of Bitcoin activities over a specific period. Once filled, each block is added to the existing chain in a linear fashion, creating an immutable trail of transactions.

How Blocks Communicate with Each Other

The connectivity between blocks establishes a robust framework wherein each block references its predecessor via the unique cryptographic hash. This chaining mechanism ensures the integrity of the entire blockchain; if anyone attempts to modify a block, they must also change every subsequent block, which is computationally unfeasible due to the hashing algorithms employed.

Additionally, the communication between blocks is facilitated by nodes in the Bitcoin network, which validate transactions and relay information. These nodes ensure that all copies of the blockchain remain synchronized across the network, preserving accuracy and consistency.

The Concept of Forks in Bitcoin’s Blockchain

While Bitcoin’s blockchain typically maintains a single chain, there are instances where forks occur. A fork refers to a divergence in the blockchain, resulting in two separate chains. There are two primary types of forks:

- Soft Fork: A backward-compatible method that allows older nodes to accept new rules without needing to upgrade.

- Hard Fork: A radical change to the protocol that creates an incompatibility between the old version and the new version, leading to the creation of two distinct cryptocurrencies (e.g., Bitcoin and Bitcoin Cash).

Understanding forks is essential for recognizing how Bitcoin evolves and adapts to technological advancements and community needs, often sparking debates within the ecosystem regarding governance and direction.

Key Components of the Bitcoin Blockchain

The Bitcoin blockchain is composed of several integral components that work together seamlessly to ensure transactions are secure, reliable, and efficient. By exploring these key components, we can gain a deeper understanding of how they contribute to Bitcoin’s functionality and overall robustness.

Nodes: Guardians of the Network

Nodes are individual computers that participate in the Bitcoin network. They play a critical role in maintaining and validating the blockchain by storing a copy of the entire ledger. Each node has the responsibility to propagate transactions and blocks throughout the network, ensuring that all participants have access to up-to-date information.

There are different types of nodes within the Bitcoin ecosystem:

- Full Nodes: Maintain a complete copy of the blockchain and enforce the rules of the network by validating transactions and blocks.

- Lightweight Nodes (SPV Nodes): Hold only a subset of the blockchain and rely on full nodes for transaction verification, making them more efficient for mobile devices and less powerful hardware.

The diversity of nodes contributes to the decentralization and resilience of the Bitcoin network, as no single entity controls the network. Instead, it operates collectively through the cooperation of all participating nodes.

Miners: The Backbone of Transaction Validation

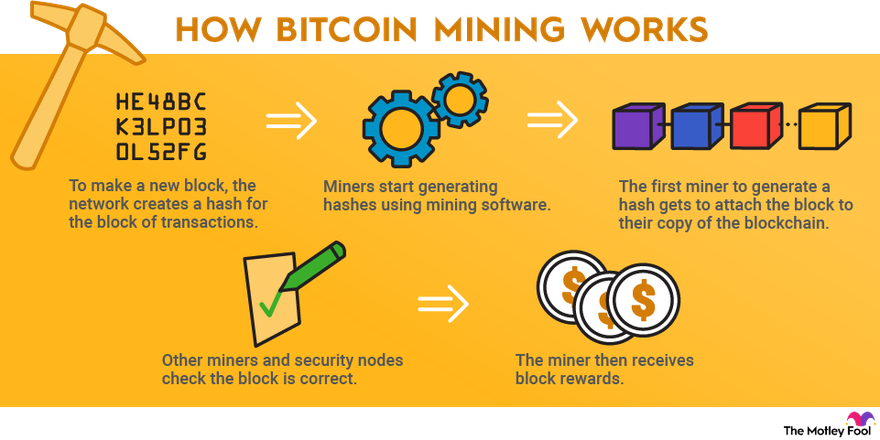

Miners are specialized nodes that perform the vital function of validating transactions and adding new blocks to the blockchain. They do this by solving complex mathematical problems—known as proof-of-work—through a process called mining.

Mining involves:

- Transaction Verification: Miners collect unconfirmed transactions broadcasted by users and compile them into a candidate block.

- Solving the Puzzle: Miners compete to solve a cryptographic puzzle, which requires significant computational power. The first miner to find the solution gets the right to add their block to the blockchain and is rewarded with newly minted Bitcoins and transaction fees.

- Block Propagation: Once a miner successfully mines a block, they broadcast it to other nodes in the network, effectively updating everyone’s copy of the blockchain.

This competitive environment not only secures the network but also incentivizes miners to maintain honest behavior, as they stand to lose potential rewards if they attempt to cheat the system.

Wallets: User Interfaces for Transactions

Wallets serve as the user interface for interacting with the Bitcoin network. They enable users to send, receive, and manage their Bitcoin holdings, providing a way to store their private keys securely.

There are different types of wallets:

- Hot Wallets: Connected to the internet, making them convenient for immediate transactions but more vulnerable to hacking.

- Cold Wallets: Offline storage solutions, such as hardware wallets or paper wallets, offering enhanced security against online threats.

Understanding the functionalities and security features of different wallet types is crucial for users to protect their investments and navigate the complexities of the Bitcoin ecosystem effectively.

How Bitcoin Transactions are Added to the Blockchain

Adding Bitcoin transactions to the blockchain is a systematic process that involves multiple steps to ensure security, validation, and consensus among network participants. Understanding this process is essential for grasping how Bitcoin operates at its core.

Initiation of a Transaction

The journey of a Bitcoin transaction begins when a user creates a transaction using their wallet software. This transaction includes details such as:

- Sender’s Address: The public key of the sender, where the Bitcoin will be deducted from.

- Receiver’s Address: The public key of the recipient, indicating where the funds will be sent.

- Amount: The quantity of Bitcoin being transferred.

- Transaction Fee: An optional fee paid to miners to incentivize them to prioritize the transaction in the next block.

Once the transaction information is finalized, the wallet software generates a digital signature using the sender’s private key, ensuring authenticity and integrity.

Broadcasting and Verification Process

After the transaction is signed, it is broadcasted to the Bitcoin network, where it enters the mempool—a pool of unconfirmed transactions awaiting validation. Miners continuously monitor the mempool, selecting transactions based on the offered fees and other criteria.

As miners pick transactions to include in the next block, they validate their authenticity by checking the following:

- Sufficient Balance: Ensuring that the sender has enough Bitcoin to cover the transaction amount.

- Digital Signature: Confirming that the transaction was indeed authorized by the sender.

The successful verification leads to the inclusion of the transaction in the candidate block compiled by the miner.

Finalization and Confirmation of Transactions

Once a miner successfully solves the proof-of-work puzzle and adds the block containing the transaction to the blockchain, the transaction is considered confirmed. However, it is essential for users to understand that further confirmations increase security.

In practice, a transaction is generally regarded as secure after receiving six confirmations, meaning that six additional blocks have been added after the block containing the transaction. This multi-tiered confirmation process mitigates the risk of double-spending and enhances confidence in the integrity of the transaction.

Security and Decentralization: The Backbone of Bitcoin’s Blockchain

Security and decentralization are two fundamental tenets underlying the success of Bitcoin’s blockchain architecture. Together, they create a resilient network capable of resisting attacks while fostering trust and participation.

The Role of Cryptography in Security

Cryptography plays a pivotal role in securing Bitcoin transactions and protecting user information. Key cryptographic techniques employed in Bitcoin include:

- Hash Functions: Bitcoin uses the SHA-256 hash function to create a unique output for any input. This ensures that even minor changes in transaction data result in significantly different hashes, making tampering easily detectable.

- Public-Key Cryptography: Each Bitcoin user possesses a pair of cryptographic keys—the public key (shared with others) and the private key (kept secret). The private key enables users to sign transactions, while the public key allows recipients to verify the signature’s authenticity.

By leveraging advanced cryptographic methods, Bitcoin ensures that transactions remain secure and transparent, enabling trust without the need for intermediaries.

Decentralization: Power to the People

Decentralization eliminates reliance on central authorities and distributes control across the network. This characteristic insulates the Bitcoin ecosystem from manipulation, censorship, and malicious attacks.

Key aspects of decentralization in the Bitcoin blockchain include:

- Distributed Consensus: All nodes work collaboratively to achieve consensus on the state of the blockchain, requiring a majority agreement before any modifications can occur. This prevents any single entity from exerting control over the network.

- Immutability of Data: Once a block is added to the blockchain, altering it requires overwhelming computational power to outpace the network, making fraud attempts exceedingly difficult.

The decentralized nature of Bitcoin creates a trustless environment where users can interact directly. The absence of a central authority fosters financial inclusion, allowing individuals from diverse backgrounds and geographical locations to participate in the global economy.

Challenges to Security and Decentralization

Despite its strengths, Bitcoin’s security and decentralization face ongoing challenges. As the network grows, the following concerns have emerged:

- 51% Attacks: If a group of miners controls more than 50% of the network’s hashing power, they could potentially double-spend transactions or censor others. While rare, this scenario highlights the need for a diverse and distributed mining ecosystem.

- Centralized Mining Pools: Many miners join mining pools to combine resources, but this can lead to centralized power dynamics if a few pools dominate the network. Striking a balance between efficiency and decentralization remains a challenge.

Addressing these issues requires ongoing vigilance and innovation to ensure that Bitcoin continues to thrive as a decentralized and secure digital currency.

Understanding the Differences: Blockchain vs. Bitcoin

As we wrap up our exploration of blockchain technology in Bitcoin, it’s essential to clarify the distinctions between the two concepts. While they are intrinsically linked, they represent different facets of a broader paradigm shift in finance and technology.

Defining Blockchain Technology

Blockchain is a decentralized digital ledger technology that records transactions across multiple computers in a secure and immutable manner. Its primary characteristics include:

- Distributed Ledger: Information is replicated across multiple nodes, promoting transparency and reducing the risk of single points of failure.

- Consensus Mechanisms: Various protocols, like proof-of-work, govern how transactions are validated and added to the blockchain.

Blockchain technology has vast applications beyond cryptocurrency, including supply chain management, healthcare record-keeping, voting systems, and more. It offers solutions for enhancing transparency, traceability, and efficiency in various industries.

Bitcoin: A Cryptocurrency Built on Blockchain

Bitcoin, on the other hand, is a specific application of blockchain technology designed to function as a decentralized digital currency. While Bitcoin leverages blockchain for transaction recording and security, its primary purpose is to facilitate peer-to-peer financial transactions without intermediaries.

Characteristics of Bitcoin include:

- Scarcity and Value: Bitcoin has a capped supply of 21 million coins, instilling value through scarcity and demand dynamics.

- Monetary Policy: The issuance of new Bitcoins occurs through a controlled process known as halving, which reduces mining rewards over time and influences market supply.

Bitcoin has sparked interest globally, leading to discussions about its viability as a store of value, medium of exchange, and hedge against inflation.

The Interconnectedness of Blockchain and Bitcoin

While blockchain and Bitcoin are distinct, they are interconnected in profound ways. Blockchain technology provides the fundamental infrastructure that enables Bitcoin to operate, allowing for secure, transparent, and verifiable transactions. Conversely, Bitcoin serves as a practical demonstration of blockchain’s capabilities, showcasing its potential to disrupt traditional financial systems.

The relationship between the two extends into emerging technologies and innovations, with blockchain paving the way for new cryptocurrencies and decentralized applications, while Bitcoin remains at the forefront of the cryptocurrency movement.

Conclusion

In conclusion, understanding what is blockchain in Bitcoin unveils the intricate relationship between these two revolutionary structures. Blockchain technology serves as the foundation upon which Bitcoin operates, facilitating secure, transparent, and immutable transactions in a decentralized environment. Through its unique components, such as nodes, miners, and wallets, Bitcoin exemplifies how blockchain can transform the landscape of digital finance, fostering greater trust and accessibility. As we continue to explore the evolution of both blockchain and Bitcoin, it is clear that their intertwined destinies hold the potential to reshape economies, industries, and the very nature of trust in the digital age.