How to Store Bitcoin Securely – A Complete Guide for Investors

In the world of digital currencies, knowing how to store Bitcoin securely is crucial for both novice and experienced investors. As Bitcoin gains traction in mainstream finance, its security has become a primary concern for users. Without effective storage methods, your investment can be subject to theft, fraud, or loss. This guide will delve into various aspects of Bitcoin security, providing you with an extensive understanding of how to keep your assets safe.

Understanding Bitcoin Security Risks and Vulnerabilities

Bitcoin security is not just about technology; it encompasses a wide range of factors that affect the safety of your investments. Understanding the risks and vulnerabilities associated with Bitcoin will help you take the necessary precautions to protect your assets.

The Nature of Bitcoin Cryptocurrency

Bitcoin operates on a decentralized network, which means that there is no central authority overseeing transactions or user accounts. While this decentralization offers benefits such as censorship resistance and transparency, it also introduces unique security challenges.

One of the major risks is that once a transaction is recorded on the blockchain, it cannot be reversed. This makes it imperative for users to ensure they are sending funds to the correct addresses, as mistakes could result in irreversible losses.

Moreover, the anonymity associated with Bitcoin can lead to malicious actors exploiting unsuspecting users. Scams, phishing attacks, and hacking attempts are rampant in the cryptocurrency space, making it essential for individuals to remain vigilant.

Common Security Threats to Bitcoin Holders

There are several prevalent threats that Bitcoin holders face today:

- Hacking: Cybercriminals often target exchanges, wallets, and individual users to steal funds. High-profile hacks have resulted in millions of dollars being lost.

- Phishing Attacks: These attacks usually involve fraudulent emails, websites, or messages that trick users into revealing their private keys or login credentials.

- Malware and Ransomware: Malicious software can infiltrate your devices and provide hackers access to your wallet, leading to potential losses.

- Physical Theft: If hardware wallets or paper wallets are not stored securely, they can be stolen physically, resulting in a total loss of your Bitcoin holdings.

Understanding these risks allows you to identify protective measures you can take when managing your Bitcoin.

The Importance of Education and Awareness

Education and awareness play a vital role in mitigating risks. New Bitcoin investors should spend time learning about the different types of wallets, security practices, and even community warnings about ongoing scams. Regularly staying informed about emerging threats can significantly reduce your chances of becoming a victim.

Investing time in research, forums, and communities dedicated to Bitcoin can enhance your understanding of potential vulnerabilities and best practices for secure storage. Engaging with knowledgeable individuals can provide invaluable insights and real-world experiences that will further bolster your defenses against potential threats.

Choosing the Right Bitcoin Wallet: A Comprehensive Guide

Selecting the correct wallet is fundamental to successfully storing Bitcoin. Different wallet types offer varying levels of security, accessibility, and user control.

Types of Bitcoin Wallets

There are three main categories of Bitcoin wallets: software wallets, hardware wallets, and paper wallets. Each type has its advantages and disadvantages.

- Software Wallets: These wallets can be desktop or mobile applications. They allow easy access to your Bitcoins but are more susceptible to hacking.

- Hardware Wallets: Physical devices designed specifically for storing cryptocurrency offline. They are considered one of the safest options due to their resistance to online threats.

- Paper Wallets: A physical printout containing your private and public keys. They are immune to online threats but can be easily lost or damaged if not carefully stored.

Choosing the right wallet depends on your needs as an investor, your technical expertise, and your risk tolerance.

Factors to Consider When Selecting a Wallet

When deciding on a Bitcoin wallet, consider the following factors:

- Security Features: Look for wallets that offer strong encryption, 2FA, and multi-signature capabilities. These features add additional layers of protection.

- User Experience: A wallet should have an intuitive interface that simplifies the process of buying, selling, and managing Bitcoin.

- Backup and Recovery Options: Ensure that the wallet provides ways to back up your data and recover your account in case of loss or theft.

- Community Feedback: Research reviews and user feedback to gauge the reliability and security of the wallet. Established wallets with positive reputations are typically a safer choice.

Recommended Bitcoin Wallets

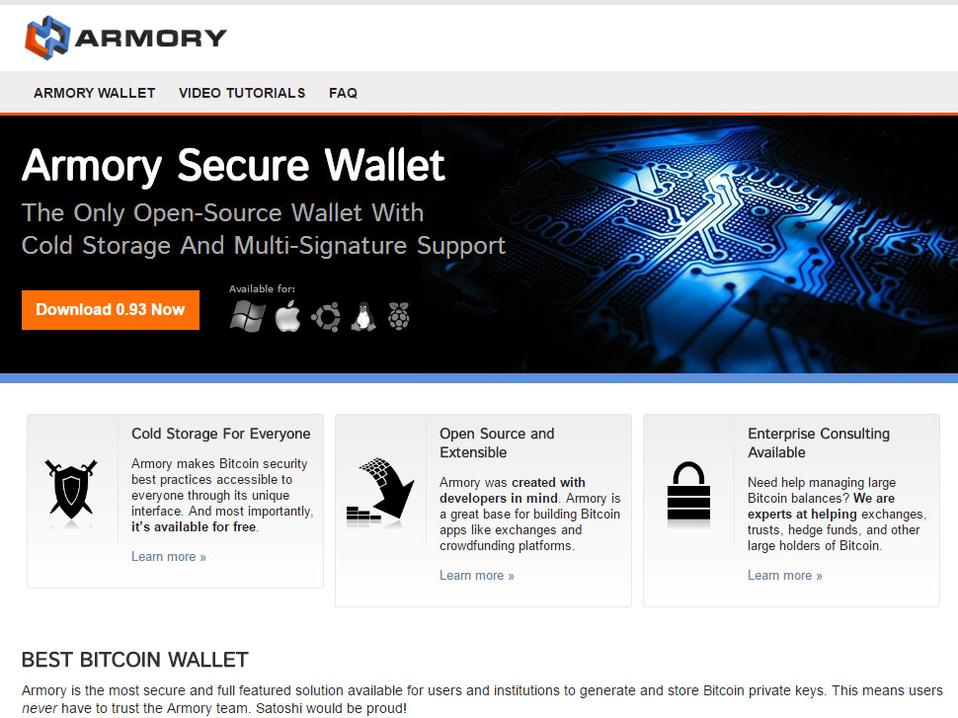

Though personal preferences may vary, here are some highly recommended Bitcoin wallets:

- Ledger Nano X: A leading hardware wallet known for its high-security standards and user-friendly interface.

- Trezor Model T: Another reputable hardware wallet that allows multiple cryptocurrencies to be stored securely.

- Exodus: A popular software wallet that offers a clean interface and easy access to various cryptocurrencies.

- Electrum: A lightweight Bitcoin wallet suitable for those who prioritize speed without sacrificing security.

Choosing the right wallet is critical to ensuring that you know how to store Bitcoin securely. Take your time to analyze the options available and select the one that aligns best with your requirements.

Implementing Strong Passwords and Two-Factor Authentication (2FA)

One of the simplest yet most effective strategies for enhancing your Bitcoin security is implementing strong passwords and enabling Two-Factor Authentication (2FA).

The Significance of Strong Passwords

Creating robust passwords is pivotal to protecting your digital assets. Weak passwords make it easier for attackers to gain unauthorized access to your accounts.

- Characteristics of Strong Passwords: A strong password should ideally be at least 12 characters long and contain a mix of uppercase letters, lowercase letters, numbers, and special symbols. Avoid using easily guessable information such as birthdays, names, or common words.

- Password Managers: Utilizing a password manager can help you create and store complex passwords securely. These tools generate random passwords and encrypt them, ensuring that only you can access your accounts.

Enabling Two-Factor Authentication (2FA)

2FA adds an additional layer of security by requiring users to provide two forms of identification before accessing their accounts.

- Types of 2FA: 2FA methods can include SMS codes, authentication apps, biometric recognition (like fingerprints), or hardware tokens. Each method has its pros and cons, but generally, using an authenticator app like Google Authenticator or Authy is considered more secure than SMS-based verification.

- How to Enable 2FA: Most reputable wallets and exchanges provide the option to enable 2FA. Take the time to navigate through account settings and activate this important layer of protection.

Educating Yourself About Security Protocols

Aside from passwords and 2FA, educate yourself about other security protocols. Stay updated on best practices for online security, including recognizing phishing attempts, avoiding unsecured networks, and utilizing virtual private networks (VPNs) when accessing your accounts.

Knowing how to store Bitcoin securely requires a proactive approach when it comes to securing your accounts.

Cold Storage vs. Hot Storage: Balancing Security and Accessibility

A significant decision for any Bitcoin holder is whether to use cold storage or hot storage. Understanding the differences between these two storage types can help you choose the most suitable option for your needs.

What Is Cold Storage?

Cold storage refers to a method of storing Bitcoin that is not connected to the internet. This practice helps safeguard your assets from online threats.

- Types of Cold Storage: Common cold storage methods include hardware wallets, paper wallets, and air-gapped computers (devices that have never been connected to the internet).

- Advantages of Cold Storage: The primary advantage of cold storage lies in its security. Since cold wallets do not have internet access, they are less vulnerable to hacking and phishing attacks. For long-term investors looking to hold large amounts of Bitcoin, cold storage is often the preferred option.

What Is Hot Storage?

Hot storage, on the other hand, refers to any storage method that is connected to the internet. This includes online wallets and exchanges.

- Benefits of Hot Storage: Hot storage allows for quick and easy access to your Bitcoin, making it suitable for active traders or those who frequently transact. Additionally, many hot wallets offer user-friendly interfaces that simplify the process of managing cryptocurrencies.

- Risks of Hot Storage: However, hot storage comes with inherent risks. Being online exposes these wallets to cyber attacks, so users must take extra precautions to secure their funds.

Finding the Right Balance

For many investors, a balanced approach can yield the best results. Consider keeping a portion of your Bitcoin in hot storage for immediate access while storing the majority in cold storage for enhanced security.

A diversified strategy allows you to enjoy the convenience of hot wallets while minimizing your exposure to potential threats. Always remember that understanding how to store Bitcoin securely involves evaluating your personal circumstances and adapting your storage methods accordingly.

Best Practices for Securing Your Bitcoin Wallet and Private Keys

Securing your Bitcoin wallet and private keys is paramount to maintaining the integrity of your digital assets. Adhering to best practices can significantly reduce the likelihood of unauthorized access.

Securing Private Keys

Your private key is essentially the password that grants access to your Bitcoin. Keeping it secure should be your top priority.

- Never Share Your Private Key: No legitimate service will ask you for your private key. If someone requests it, be suspicious. Sharing your private key can lead to losing your Bitcoin permanently.

- Use Multi-Signature Wallets: Multi-signature wallets require multiple signatures (private keys) for transactions. This added layer of security ensures that even if one key is compromised, the Bitcoin remains protected.

Backing Up Your Wallet

Regular backups are essential for ensuring that you can recover your funds in case of device failure or loss.

- Backup Methods: Depending on the wallet you choose, backup methods can differ. Some wallets offer automatic backups, while others require manual intervention. Familiarize yourself with your wallet’s backup procedures and set reminders to perform regular backups.

- Store Backup Copies Securely: Store your backup copies in multiple secure locations, such as a safe deposit box or cloud storage with encrypted access. Mixing physical copies and digital backups can provide additional safeguards against threats.

Monitoring and Auditing Your Account

Regularly monitoring and auditing your account can help detect suspicious activity early.

- Transaction History: Frequently review your transaction history and be vigilant for any unauthorized transactions. If you spot anything unusual, take immediate action to secure your wallet.

- Stay Informed About Security Updates: Wallet providers frequently release updates to patch vulnerabilities and enhance security. Make it a habit to stay informed about these updates and apply them promptly.

By following these best practices, you will have a firm grasp on how to store Bitcoin securely, thereby ensuring your investments are well-protected.

Regular Audits and Staying Informed About Security Updates

The rapidly evolving nature of technology and cybersecurity necessitates continuous learning and adaptation. Regular audits and keeping abreast of security updates can greatly enhance your Bitcoin storage security.

Conducting Regular Security Audits

A security audit involves a thorough examination of your security measures and practices related to Bitcoin storage.

- Review Your Wallet Setup: Periodically assess your wallet setup to ensure that all security features are enabled, including strong passwords and 2FA.

- Evaluate Your Cold and Hot Storage Balance: Reassess your allocation between cold storage and hot storage based on market conditions and changes in your trading habits. Adjust your strategy accordingly.

Staying Informed

The cryptocurrency landscape is ever-changing, with new threats and innovations arising regularly.

- Follow Trusted Sources: Subscribe to reputable news outlets, blogs, and forums focused on Bitcoin and cryptocurrency. Engage with the community to share knowledge and learn from others’ experiences.

- Participate in Online Communities: Join online discussions and forums, such as Reddit or specialized crypto forums, where users share tips, experiences, and warnings about current threats.

Taking Advantage of Security Tools

Utilizing the right security tools can bolster your defenses.

- Security Software: Invest in reliable antivirus and anti-malware software to protect your devices from threats.

- VPNs and Encrypted Connections: Using a Virtual Private Network (VPN) can help shield your online activities from prying eyes, adding another layer of security.

By being proactive, conducting regular audits, and remaining informed about trends and developments, you can build a robust defense against potential threats to your Bitcoin holdings.

Conclusion

Storing Bitcoin securely is a multifaceted task that requires diligence, research, and analysis. By understanding the security risks involved, choosing the right wallet, employing strong passwords and 2FA, weighing cold versus hot storage options, following best practices, and conducting regular audits, you empower yourself to navigate the complexities of Bitcoin ownership safely. With the right strategies in place, you can confidently engage in the world of cryptocurrency while effectively safeguarding your investments.