How to Invest in Bitcoin for Long-Term Gains – A Comprehensive Guide

In today’s rapidly evolving financial landscape, investing in cryptocurrencies has become an increasingly popular choice among investors. Among the myriad of digital currencies available, Bitcoin stands out as the pioneer and arguably the most recognized cryptocurrency. For many, the question arises: How to invest in Bitcoin for long term? In this comprehensive guide, we will explore the intricacies of Bitcoin investment, strategies for success, and tips for safeguarding your asset as you embark on this exciting journey.

Introduction: Why Consider Bitcoin for Long-Term Investment?

Bitcoin has emerged as more than just a speculative asset; it has transformed into a legitimate store of value, often likened to “digital gold.” The reasons for its growing interest as a long-term investment are multifaceted, spanning technological, economic, and social dimensions.

Historically, Bitcoin has demonstrated remarkable resilience against economic instability, inflation, and geopolitical uncertainties. As central banks continue to print money and inflate fiat currencies, many investors view Bitcoin as a hedge against devaluation. Furthermore, the decentralized nature of Bitcoin provides an alternative to traditional banking systems, ensuring that individuals have autonomy over their assets.

With its finite supply capped at 21 million coins, Bitcoin introduces scarcity to the digital realm, making it potentially valuable in the long run. Such qualities position Bitcoin not only as a trading asset but also as a strategic long-term investment. Let’s delve deeper into what makes Bitcoin a compelling long-term hold.

The Rise of Institutional Adoption

One of the most significant developments in the Bitcoin landscape is the increasing acceptance of Bitcoin by institutional investors. Major corporations and investment funds have started allocating portions of their portfolios to Bitcoin, signaling a shift in perception from a risky gamble to a legitimate asset class.

- Corporate Investments: Companies like MicroStrategy and Tesla have made headlines with substantial Bitcoin purchases, showcasing confidence in its future value.

- Investment Funds: Traditional hedge funds and investment firms have launched products focusing on Bitcoin, allowing retail investors easier access to this new asset class.

- Financial Products: The development of Bitcoin ETFs (Exchange-Traded Funds) has further legitimized Bitcoin, providing regulated avenues for investors.

As institutional players enter the Bitcoin market, they contribute liquidity and stability, factors that can positively influence the asset’s price in the long term.

The Potential of Blockchain Technology

To understand Bitcoin better, one must appreciate its underlying technology: blockchain. This decentralized ledger system not only powers Bitcoin transactions but has myriad applications across industries.

- Transparency and Security: Blockchain ensures transparency through its public nature while maintaining security via cryptographic techniques. This reduces fraud and enhances trust, crucial factors for long-term viability.

- Smart Contracts: Beyond currency, blockchain technology enables smart contracts, which can redefine business agreements and automate processes, thus expanding Bitcoin’s use cases.

- Innovation and Growth: As developers continue to innovate within the blockchain space, the potential for increased adoption and new functionalities may drive demand for Bitcoin.

Given these advancements, Bitcoin’s relevance is likely to grow, suggesting a promising horizon for long-term investors.

Economic Factors Favoring Bitcoin

Several economic indicators support Bitcoin as a worthwhile long-term investment:

- Inflation Concerns: With rising inflation rates globally, many see Bitcoin as a way to preserve wealth. Its fixed supply contrasts sharply with inflationary fiat currencies.

- Global Financial Instability: Economic downturns or crises often push individuals toward assets perceived as safe havens. Historically, Bitcoin has seen surges in demand during such times.

- Access to Financial Markets: Bitcoin offers unbanked populations the opportunity to participate in the global financial system, potentially widening its user base and supporting long-term growth.

These economic factors collectively paint a promising picture for Bitcoin as a long-term investment.

Understanding Bitcoin: Fundamentals for Long-Term Holders

Before diving into the mechanics of investing, it’s vital to grasp the fundamentals of Bitcoin itself. Understanding how Bitcoin operates and its market dynamics can empower investors to make informed decisions.

What is Bitcoin?

At its core, Bitcoin is a decentralized digital currency created in 2009 by an anonymous entity known as Satoshi Nakamoto. Unlike traditional currencies issued by governments, Bitcoin operates independently of a central authority.

- Decentralization: Bitcoin relies on a peer-to-peer network of nodes that validate transactions, eliminating the need for intermediaries like banks.

- Mining and Supply: New bitcoins are created through a process called mining, where powerful computers solve complex mathematical problems. The reward for mining reduces over time, contributing to its scarcity.

- Transactions: Bitcoin transactions are recorded on the blockchain, ensuring transparency and immutability. This creates a trustless environment, as participants do not need to know each other personally to conduct transactions.

Understanding these foundational concepts prepares investors to navigate the complexities of the Bitcoin market effectively.

The Volatility of Bitcoin

While Bitcoin has shown incredible growth over the years, it is also notorious for its price volatility. Long-term investors must prepare for this aspect and develop strategies to mitigate risks associated with large fluctuations.

- Price History: Bitcoin has experienced dramatic price swings, often due to market sentiment shifts, regulatory news, or macroeconomic events.

- Fear and Greed Index: Tools like the Fear and Greed Index provide insights into market sentiment, helping investors gauge whether the market is overbought or oversold.

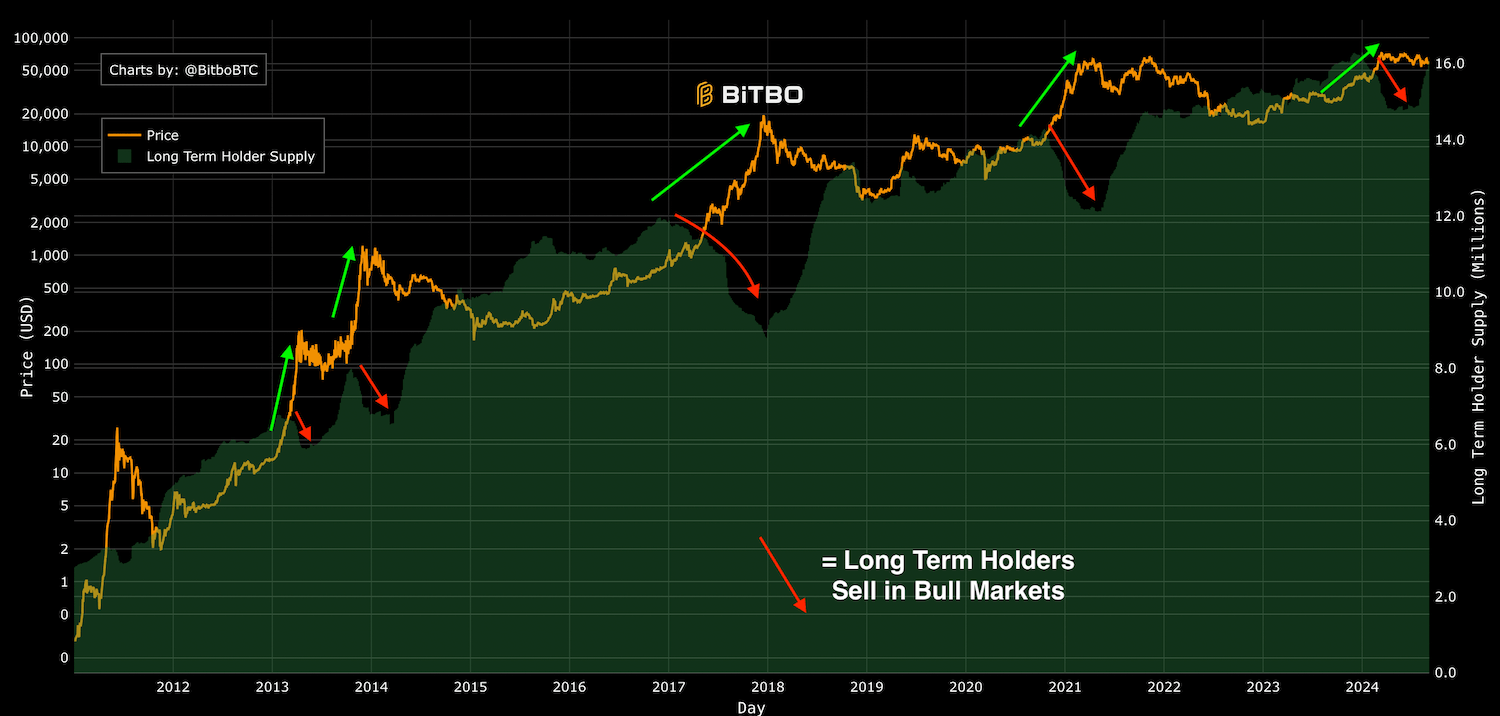

- Market Cycles: Recognizing that Bitcoin goes through cycles of boom and bust can assist investors in understanding when to enter or exit positions.

Investors should analyze historical data and trends to better anticipate potential price movements, enabling more strategic decision-making.

Key Metrics to Monitor

For those looking to invest in Bitcoin for the long term, there are several key metrics to consider:

- Market Capitalization: The total market cap can provide insights into Bitcoin’s overall health relative to other cryptocurrencies.

- Trading Volume: Monitoring trading volume can indicate market interest and momentum.

- Hash Rate: The hash rate reflects the network’s computational power, influencing security and transaction speed.

By keeping an eye on these metrics, investors can gain a clearer picture of Bitcoin’s market dynamics and performance.

Developing a Bitcoin Investment Strategy: Time Horizon and Risk Tolerance

Crafting a well-thought-out investment strategy is essential for any investor, especially in the volatile world of cryptocurrencies like Bitcoin. Understanding your time horizon and risk tolerance helps shape the approach you take.

Defining Your Time Horizon

Your time horizon refers to the length of time you plan to hold your Bitcoin investment. Establishing this upfront is critical as it influences your strategy.

- Short-Term vs. Long-Term: If you aim for short-term gains, you may find yourself trading frequently, reacting to market movements. Conversely, a long-term perspective allows you to weather price fluctuations and focus on Bitcoin’s potential growth.

- Investment Goals: Clarifying your investment goals—whether it’s wealth accumulation, retirement savings, or diversification—can help determine your time horizon.

- Life Events: Factor in significant life events that may require liquidating your investments, such as buying a home or funding education, which could impact your time horizon.

By defining your time horizon, you set the stage for how much risk you’re willing to take and how actively you’ll manage your investment.

Assessing Risk Tolerance

Risk tolerance reflects how much volatility you can withstand in your investment portfolio. Understanding this aspect is crucial for navigating the high-risk landscape of Bitcoin.

- Personal Financial Situation: Evaluate your financial circumstances, including income, expenses, and existing investments. A stable foundation may allow for a higher risk appetite.

- Psychological Factors: Consider your emotional response to losses. Some individuals may panic during downturns, while others remain calm and collected.

- Portfolio Diversification: Balancing Bitcoin with other asset classes can cushion against volatility, allowing for a more stable risk profile.

A clear sense of your risk tolerance will guide your Bitcoin investment decisions, helping you stay committed during turbulent times.

Creating Your Investment Plan

Once you’ve established your time horizon and assessed your risk tolerance, the next step is formulating a concrete investment plan.

- Allocation: Decide how much of your overall portfolio to allocate to Bitcoin. Many advisors suggest keeping cryptocurrency allocations within 5-10% for balanced exposure.

- Entry Strategy: Plan how you will enter the market—whether through lump-sum purchases or dollar-cost averaging (DCA). DCA involves investing a fixed amount regularly, reducing exposure to volatility.

- Exit Strategy: Define your criteria for selling. Whether it’s reaching specific price targets or reallocating funds based on market conditions, having an exit strategy ensures you don’t make impulsive decisions.

A well-crafted investment plan equips you with a roadmap, allowing you to navigate the ever-changing cryptocurrency landscape confidently.

Secure Storage Solutions: Protecting Your Bitcoin for the Long Haul

As the saying goes, “Not your keys, not your coins.” Security is paramount when investing in Bitcoin. Long-term holders must implement robust storage solutions to safeguard their assets from theft or loss.

Types of Bitcoin Wallets

There are various types of wallets available to store Bitcoin, each offering different levels of security and convenience.

- Hot Wallets: These are connected to the internet and offer easy access for trading. However, they are more vulnerable to hacking. Examples include exchange wallets and mobile apps.

- Cold Wallets: Cold wallets are offline storage options that provide enhanced security. They include hardware wallets (e.g., Ledger, Trezor) and paper wallets. While they are less convenient for frequent trading, they are ideal for long-term storage.

- Multi-Signature Wallets: Multi-signature wallets require multiple private keys to authorize transactions. This adds an extra layer of security, particularly for shared accounts or family holdings.

Choosing the right wallet depends on your trading frequency and security preferences. For long-term investors, cold wallets are generally recommended for maximum protection.

Best Practices for Securing Your Bitcoin

Implementing best practices for securing your Bitcoin holdings is essential for protecting your investment.

- Backup Your Wallet: Always back up your wallet and keep a secure record of your recovery phrase or private keys. Store backups in multiple locations to avoid loss.

- Enable Two-Factor Authentication (2FA): Use 2FA wherever possible, especially for online wallets and exchanges. This adds an extra layer of security beyond just passwords.

- Stay Updated on Security Threats: Cryptocurrency is a rapidly changing space, with new threats emerging regularly. Stay informed about potential scams, phishing attempts, and vulnerabilities.

- Consider Legal Protections: Depending on your jurisdiction, consider legal mechanisms for passing on your Bitcoin holdings to heirs. Create a plan for your assets in case of unforeseen circumstances.

Following these best practices ensures that your Bitcoin remains secure, enabling you to focus on long-term growth without constant worry about security breaches.

Importance of Diversification in Storage

Just as you would diversify your investment portfolio, consider diversifying your storage methods as well.

- Multiple Wallets: Storing your Bitcoin across different wallets can reduce the risk of losing all your assets in one attack or failure.

- Physical Security Measures: For hardware wallets, ensure they are kept in a secure location, such as a safe or safety deposit box, to prevent theft or damage.

- Regularly Review Your Security Setup: Periodically assess your security measures and adapt them as necessary. Technology evolves, and so do security threats.

By diversifying your storage solutions, you can enhance the overall security of your Bitcoin investments, providing peace of mind as you hold for the long term.

Dollar-Cost Averaging (DCA): A Strategy for Mitigating Volatility

Dollar-cost averaging (DCA) is an investment strategy that allows investors to mitigate the effects of market volatility. Instead of trying to time the market, DCA involves investing a fixed amount at regular intervals, regardless of price fluctuations.

Benefits of Dollar-Cost Averaging

This strategy presents several advantages for long-term investors in Bitcoin:

- Less Emotional Stress: By committing to a fixed investment schedule, you reduce the impulse to react emotionally to market movements. This discipline is crucial in the highly volatile crypto space.

- Cost-Averaging Effect: DCA allows you to buy more Bitcoin when prices are low and less when prices are high. Over time, this can lead to a lower average cost per coin compared to lump-sum investment strategies.

- Simplified Investment Approach: DCA requires less market monitoring and analysis. It aligns perfectly with a long-term investment philosophy, as you can stick to your plan without being swayed by short-term price actions.

Implementing a Dollar-Cost Averaging Strategy

If you choose to adopt a DCA strategy in your Bitcoin investment, here are some steps to get started:

- Choose Your Investment Amount: Determine a fixed amount you can comfortably invest at regular intervals, whether weekly, bi-weekly, or monthly.

- Select the Right Exchange or Platform: Ensure the platform you choose supports automated DCA features, or set reminders to manually execute your purchases.

- Stick to Your Schedule: Consistency is key. Resist the temptation to alter your contribution amounts based on market performance.

- Review Periodically: Periodically evaluate your overall investment performance and adjust your strategy if needed. You may find that your financial situation or the market environment changes.

By following a structured DCA approach, you can effectively build your Bitcoin holdings over time without succumbing to the stress of market timing.

DCA vs. Lump-Sum Investing

When establishing a Bitcoin investment strategy, it’s beneficial to weigh the pros and cons of DCA against lump-sum investing.

- DCA Advantages: As previously mentioned, DCA reduces emotional stress, mitigates volatility risks, and simplifies the investment process.

- Lump-Sum Advantages: On the flip side, lump-sum investing can capitalize on immediate price movements. If the market experiences a bull run shortly after you invest, you may achieve greater returns.

- Personal Preference: Ultimately, your choice may depend on your personality, risk appetite, and market outlook. Some investors prefer a combination of both strategies, starting with a lump sum and then conducting DCA over time.

Understanding these differences aids in selecting the method that aligns with your investment style and goals.

Monitoring and Adjusting Your Bitcoin Portfolio: Staying Informed and Adaptable

The cryptocurrency market is dynamic, necessitating ongoing monitoring and adjustments to your Bitcoin portfolio. As a long-term investor, staying informed about market trends, news, and developments is crucial for making sound decisions.

Keeping Up with Market News

Given the rapid pace of change in the cryptocurrency space, staying updated on news and trends is imperative.

- Follow Reputable Sources: Subscribe to reliable cryptocurrency news platforms and financial publications to receive insights and analyses on market developments and regulatory changes.

- Engage with Online Communities: Participate in forums and discussion groups where like-minded investors share knowledge, experiences, and perspectives on Bitcoin and the broader crypto space.

- Utilize Social Media: Platforms like Twitter and Reddit can provide real-time updates and opinions from industry experts and enthusiasts. Just exercise caution, as misinformation can spread quickly in these spaces.

Being informed empowers you to make timely adjustments, ensuring your investment strategy aligns with the current market environment.

Regular Portfolio Reviews

A systematic approach to reviewing your portfolio is essential for assessing performance and making necessary adjustments.

- Performance Assessment: Analyze your investment performance periodically. Are your holdings meeting your expectations? If not, consider what changes need to be made.

- Rebalancing: As Bitcoin fluctuates in value, your portfolio allocation might deviate from your original target. Regular rebalancing ensures your investments align with your risk tolerance and goals.

- Timing Adjustments: Be attentive to broader market trends. If significant changes occur in the cryptocurrency landscape, such as major regulation shifts or shifts in investor sentiment, consider adjusting your strategy accordingly.

Regularly reviewing your portfolio and adapting as necessary ensures that you remain agile in a fast-paced market.

Embracing Flexibility and Adaptability

The importance of flexibility cannot be overstated in the ever-evolving world of Bitcoin investing. As you build your long-term investment strategy, remember that adaptability is key.

- Learn from Experiences: Reflect on past investment decisions, successes, and failures. Adjust your strategy based on what worked well and what didn’t.

- Be Open to New Strategies: The cryptocurrency landscape is constantly innovating. Explore new investment strategies, tools, or technologies that may enhance your approach.

- Avoid Rigid Thinking: Maintain a flexible mindset that allows for adjustments when faced with new information or changing market conditions.

By fostering an adaptable mindset, you can navigate the complexities of Bitcoin investing, maximizing your potential for long-term success.

Conclusion

Investing in Bitcoin for the long term involves strategic planning, thorough understanding, and a commitment to security and monitoring. By recognizing the merits of Bitcoin as a viable asset class, developing a personalized investment strategy, and implementing effective storage solutions, you can position yourself for success in this dynamic market. Through approaches like dollar-cost averaging and maintaining a vigilant stance towards market trends, you can enhance your opportunities for growth while minimizing risks. As the cryptocurrency landscape continues to evolve, remaining informed and adaptable will empower you to navigate the intricacies of Bitcoin investing confidently.