How Bitcoin Mining Works – An In-Depth Exploration of the Process

Understanding how Bitcoin mining works is essential for anyone interested in cryptocurrency and its underlying technology. Bitcoin mining serves as the backbone of the Bitcoin network, allowing transactions to be verified and added to the blockchain. It not only secures the network but also plays a pivotal role in introducing new bitcoins into circulation. This article provides a comprehensive overview of Bitcoin mining, delving into its mechanics, technologies, economic incentives, environmental considerations, and future trends.

Bitcoin Mining: A Comprehensive Overview of the Process

Bitcoin mining can be defined as the process through which new bitcoins are created and transactions are confirmed on the Bitcoin network. Miners utilize specialized hardware to solve complex mathematical problems that validate transactions, securing the network in the process. The entire ecosystem is maintained by competition among miners, each vying to be the first to solve these puzzles and add a block to the blockchain.

The process begins with a transaction request; when users initiate a transaction, it gets broadcasted to the network. Miners collect these transactions into a pool known as the mempool. From this pool, they select transactions based on fees offered by users or other criteria. Once a miner accumulates enough transactions to form a block, they begin the arduous task of solving a cryptographic puzzle—a key aspect of the consensus mechanism known as Proof-of-Work (PoW).

The first miner to solve this puzzle shares their findings with the network, allowing other nodes to verify the solution. If verified, the new block is added to the blockchain, and the miner is rewarded with newly minted bitcoins, alongside transaction fees from the included transactions. This reward system incentivizes miners to continue supporting the network, thus ensuring its longevity and security.

The Lifecycle of a Bitcoin Transaction

In order to appreciate how Bitcoin mining works, it’s crucial to understand the lifecycle of a typical Bitcoin transaction:

When a user initiates a transaction, it goes through several stages:

- Creation: Users create a transaction using their wallets.

- Broadcasting: This transaction is sent out to the Bitcoin network, where it awaits validation.

- Mempool: All incoming transactions enter the mempool, where miners can access them.

- Verification: Miners select transactions and bundle them into blocks.

- Mining: Miners compete to solve the cryptographic puzzle associated with the block.

- Confirmation: After successful validation, the block is added to the blockchain.

- Completion: The transaction is considered complete once it has been confirmed multiple times.

This lifecycle illustrates the collaborative nature of the Bitcoin network, where every transaction relies on the integrity and participation of miners.

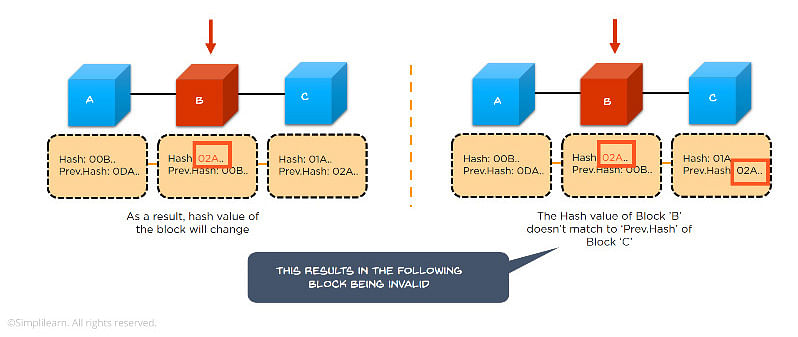

The Role of Blockchain Technology

At the heart of Bitcoin mining lies blockchain technology. A blockchain is essentially a distributed ledger that records all transactions chronologically. Each block links to its predecessor, forming an immutable chain that is nearly impossible to alter without consensus from the majority of the network. This structure underpins the security model of Bitcoin; any attempt at tampering would require altering not just one block, but all subsequent blocks, which is computationally infeasible due to the enormous amount of resources required.

The decentralized nature of blockchain technology means that no single entity controls the network, creating transparency and trust among participants. Every node within the network holds a copy of the blockchain, hence ensuring redundancy and resilience against attacks.

The Importance of Decentralization

Decentralization is a core principle of Bitcoin and its mining process. Unlike traditional financial systems controlled by central banks or institutions, Bitcoin operates on a peer-to-peer network, reducing the risk of fraud and censorship. This decentralization extends to mining; multiple independent miners contribute to the network’s security, making it resistant to manipulation or control by any single party.

Moreover, decentralization fosters innovation and inclusivity, allowing anyone with the requisite hardware and internet access to participate in mining. This opens up opportunities for users across various socio-economic backgrounds, aligning with the foundational ethos of cryptocurrency.

The Mechanics of Proof-of-Work: How Bitcoin Mining Secures the Network

To gain deeper insights into how Bitcoin mining works, we need to explore the mechanics of Proof-of-Work (PoW), the consensus algorithm that Bitcoin employs to secure its network. PoW is integral to preventing double-spending and ensures that all transactions are legitimate.

Proof-of-Work involves complex cryptographic problems that miners must solve to validate transactions and create new blocks. The difficulty of these problems adjusts approximately every two weeks to maintain a stable block generation time of roughly ten minutes per block. This adjustment ensures that the network remains resilient, even as more miners join the competition.

The Puzzle: Hashing Algorithms

At the core of the Proof-of-Work system is hashing, specifically the SHA-256 (Secure Hash Algorithm 256-bit) function. When miners create a new block, they include a header containing a list of transactions, a timestamp, and a nonce—a random number used to generate different hash outputs. The objective is to find a nonce that results in a hash lower than a predetermined target, known as the “difficulty level.”

The hashing process is simple yet powerful:

- The miner inputs the block header into the SHA-256 algorithm.

- The output is a 256-bit string that appears random and is difficult to reverse-engineer.

- If this hash meets the specified difficulty target, the block is valid.

This race to discover a valid hash exemplifies competition among miners, as the first to succeed earns the right to add the block to the blockchain and claim the associated rewards.

Difficulty Adjustment and Network Security

Bitcoin’s protocol includes a built-in mechanism for adjusting the difficulty of mining approximately every 2,016 blocks, or about two weeks. This adjustment is crucial to maintaining the average block time of ten minutes. If blocks are being mined too quickly, the difficulty increases; if too slowly, it decreases.

This dynamic adjustment makes the network resilient against changes in computational power, ensuring that block generation remains consistent. As more miners enter the fray, the competition heightens, thereby enhancing overall network security. The constant recalibration deters potential attackers, as they would need to amass significant hashing power to manipulate the blockchain successfully.

The Double-Spend Problem

One of the critical challenges that Bitcoin miners help to solve is the “double-spend problem,” which refers to the potential risk that a digital currency can be spent twice. In traditional finance, institutions prevent this risk; however, Bitcoin operates in a decentralized environment without a central authority.

By requiring miners to validate and confirm transactions, Bitcoin effectively eliminates the double-spend risk. Whenever a transaction occurs, miners ensure that the sender has sufficient funds and that the transaction hasn’t already been included in a previously confirmed block. This verification process builds trust among users while maintaining the integrity of the blockchain.

Hardware and Software: Essential Tools for Bitcoin Mining

As Bitcoin mining has evolved, so too have the tools necessary to participate in this rewarding yet challenging process. From specialized hardware to advanced software, understanding these components is vital to comprehending how Bitcoin mining works efficiently.

The choice of mining equipment can significantly impact profitability, requiring miners to stay updated on technological advancements and market trends.

Mining Hardware: ASICs vs. GPUs

When Bitcoin first emerged, miners could use standard CPUs to mine blocks. However, as difficulty levels increased, miners turned to more efficient hardware. Today, Application-Specific Integrated Circuits (ASICs) dominate the mining landscape due to their high performance and energy efficiency.

- ASIC Miners: These devices are custom-built for Bitcoin mining, offering vastly superior hashing power compared to traditional hardware. While initial costs can be high, ASIC miners provide greater returns on investment due to their efficiency.

- GPU Miners: Graphics Processing Units (GPUs) were once popular amongst miners for their versatility. They remain advantageous for mining altcoins but have largely been phased out for Bitcoin mining due to ASICs’ dominance.

Choosing the right type of hardware depends on individual goals, electricity costs, and the current state of the mining industry.

Essential Mining Software

Beyond hardware, miners require software to connect their devices to the Bitcoin network. Mining software facilitates the communication between the miner and the blockchain while managing tasks such as:

- Pool Management: For most miners, joining mining pools can enhance profitability. Pool software allows miners to collaborate and share processing power, increasing the chances of solving blocks collectively.

- Monitoring Tools: Many mining software options come with dashboards that display real-time data on hash rates, temperature, and power consumption, helping miners optimize their operations.

Additionally, open-source software options allow community contributors to improve mining code, further enhancing efficiency and functionality.

Choosing the Right Mining Pool

For many amateur miners, mining solo can be challenging and less profitable. As a result, many opt to join mining pools—groups of miners who combine their computational resources to increase the probability of discovering blocks.

When selecting a mining pool, consider the following factors:

- Reputation: Research the pool’s history and success rate to ensure reliability.

- Fees: Most pools charge fees for their services, typically ranging between 1% to 3%. Understanding the fee structure is essential for assessing profitability.

- Payout Methods: Different pools offer various payout methods, including Pay-Per-Share (PPS) or Pay-Per-Last-N-Shares (PPLNS). Familiarizing yourself with these options will help align your income expectations.

Joining a reputable mining pool can provide a steady stream of income, easing the burden of individual mining efforts.

The Economic Incentives: Understanding Bitcoin Mining Rewards

Central to how Bitcoin mining works is the economic incentive structure designed to motivate miners. By participating in the Bitcoin network, miners receive rewards in the form of newly created bitcoins and transaction fees. This dual-pronged incentive structure is fundamental for sustaining mining activities and augmenting network security.

Block Rewards: The Creation of New Bitcoins

Every time a miner successfully adds a new block to the blockchain, they receive a block reward. Initially set at 50 bitcoins per block, the reward undergoes halving approximately every four years, an event that reduces the supply of new bitcoins and creates scarcity. Currently, the reward stands at 6.25 bitcoins, with the next halving expected in 2024.

This halving mechanism is crucial for controlling inflation within the Bitcoin economy. As fewer new bitcoins are generated, the existing supply becomes more valuable over time. This inherent scarcity mirrors precious metals, making Bitcoin appealing as a store of value.

Transaction Fees: An Additional Revenue Stream

In addition to block rewards, miners earn transaction fees from the transactions they include in their blocks. Users often attach fees to their transactions to incentivize miners to prioritize them. As more people adopt Bitcoin and transaction volumes increase, transaction fees become an increasingly important source of income for miners.

The relationship between transaction volume and fees is profound. During peak demand periods, miners can earn substantial revenue from transaction fees alone, highlighting the cyclical nature of mining profitability.

The Impact of Market Dynamics on Mining Profitability

Several factors influence the economics of Bitcoin mining, impacting both revenue and costs:

- Electricity Costs: Mining is energy-intensive; thus, location plays a significant role in mining profitability. Areas with lower electricity prices can provide a competitive edge.

- Hashrate Competition: As more miners join the network, the total hashrate increases, leading to heightened competition for rewards. This directly impacts the likelihood of receiving block rewards and transaction fees.

- Market Value of Bitcoin: The price of Bitcoin itself heavily influences mining profitability. During bull markets, the potential rewards can outweigh operational costs; conversely, bear markets may render mining less feasible.

Miners must continuously evaluate these dynamics to make informed decisions regarding investments and sustainability.

Environmental Impact and Sustainability in Bitcoin Mining

As the popularity of Bitcoin mining has surged, so too have concerns regarding its environmental impact. Understanding the ecological consequences of mining operations is critical for evaluating the long-term viability of Bitcoin as a sustainable financial system.

Energy Consumption of Bitcoin Mining

The energy-intensive nature of Bitcoin mining has generated considerable debate. Estimates suggest that Bitcoin mining consumes as much energy as some small countries. This immense energy demand primarily arises from the computational power needed to solve cryptographic puzzles and validate transactions.

Critics argue that this energy usage contributes to carbon emissions and environmental degradation. On the other hand, proponents highlight that energy consumption is not inherently negative; rather, it can drive advancements in renewable energy and efficiency.

Renewable Energy Solutions

As discussions around sustainability progress, many miners are shifting their focus toward renewable energy sources. By leveraging wind, solar, hydroelectric, or geothermal energy, miners can reduce their carbon footprint while contributing to a greener ecosystem.

Some innovative projects aim to establish mining farms near renewable energy facilities, promoting a symbiotic relationship between energy production and mining. These initiatives underscore the potential for Bitcoin mining to align with sustainability goals and encourage the adoption of clean energy.

Innovations in Mining Efficiency

Technological advancements continue to play a vital role in mitigating the environmental impact of Bitcoin mining. Efforts to develop more efficient mining hardware, like improved ASIC designs, can lead to lower energy consumption per hash. Additionally, innovations in cooling solutions can enhance the overall efficiency of mining rigs.

Furthermore, some companies are exploring ways to repurpose waste energy for mining activities. Capturing flare gas from oil extraction or harnessing excess energy from power grids represents innovative approaches to reducing the ecological footprint of Bitcoin mining.

Future Trends and Innovations in Bitcoin Mining Technology

As Bitcoin continues to evolve, so does the technology surrounding its mining process. Staying abreast of emerging trends and innovations is crucial for understanding how Bitcoin mining works and anticipating its future trajectory.

Transition to Proof-of-Stake?

While Bitcoin currently utilizes the Proof-of-Work consensus mechanism, discussions about alternative models like Proof-of-Stake (PoS) have gained traction. PoS systems rely on validators who hold and “stake” their coins instead of competing through computational power.

Although not directly applicable to Bitcoin due to its foundational principles, observing the developments in PoS can inform the broader discussion around cryptocurrency consensus mechanisms.

Layer 2 Solutions and Scalability

With Bitcoin’s popularity comes challenges related to scalability and transaction throughput. Layer 2 solutions like the Lightning Network aim to address these issues by enabling faster and cheaper transactions without congesting the main blockchain.

These solutions may indirectly impact mining operations by altering transaction dynamics—potentially lowering fees but increasing transaction volume. Miners must adapt to these evolving conditions to remain competitive.

Improved Mining Techniques and Technologies

Emerging technologies continue to reshape the landscape of Bitcoin mining. Innovations in artificial intelligence and machine learning may enhance mining strategies, optimizing energy usage and operational efficiency.

Furthermore, advanced cooling techniques, modular mining setups, and automated maintenance systems can streamline mining processes and reduce downtime. Embracing these advancements will be critical for miners aiming to maximize profitability while minimizing their ecological footprint.

Conclusion

Understanding how Bitcoin mining works unveils a complex tapestry woven from cryptographic puzzles, economic incentives, and technological innovations. As miners validate transactions and secure the network, they play a vital role in the broader cryptocurrency ecosystem. With ongoing discussions about sustainability and evolving technologies, the future of Bitcoin mining promises to be a dynamic interplay between innovation and ecological responsibility. Embracing these changes will be essential for the continued growth of Bitcoin and its acceptance as a transformative financial system.