Top Bitcoin ETFs to Watch – A Comprehensive Guide to Investing in Digital Currency Funds

The landscape of cryptocurrency investing is evolving rapidly, with Bitcoin leading the charge as the most recognized and valuable digital asset. Among the innovative financial instruments that have emerged are exchange-traded funds (ETFs) focusing on Bitcoin. For investors looking to diversify their portfolios without directly buying and storing cryptocurrencies, these ETFs offer a compelling solution. In this blog post, we will explore the Top Bitcoin ETFs to watch, analyzing their features, performance, and what makes them stand out in the dynamic world of cryptocurrency investment.

Introduction: The Rise of Bitcoin ETFs

Bitcoin ETFs represent a significant advancement in how institutional and retail investors can access Bitcoin exposure in a regulated environment. Since Bitcoin’s inception in 2009, its meteoric rise has captured the attention of investors globally. With increasing adoption by mainstream financial institutions and regulatory acceptance, Bitcoin has transitioned from a niche asset to a legitimate investment vehicle.

Understanding Bitcoin ETFs

An ETF is an investment fund that trades on stock exchanges, much like individual stocks. It typically tracks an index, commodity, or a basket of assets. Bitcoin ETFs aim to provide investors with a return that correlates closely with the price movement of Bitcoin. These funds have eliminated many barriers to entry for traditional investors who may be hesitant to navigate the complexities of buying and securing Bitcoin directly.

The Growing Popularity of Bitcoin ETFs

The surge in popularity can be attributed to several factors:

- Accessibility:

Bitcoin ETFs allow investors to gain exposure to Bitcoin without needing to open a cryptocurrency exchange account or manage a digital wallet. This ease of access is enticing for those who may be intimidated by the technology involved in direct Bitcoin purchases.

- Regulatory Framework:

As more countries and regions recognize and regulate Bitcoin, ETFs have become a viable option for investors seeking legitimacy and protection under established financial laws. Regulatory approval provides confidence to institutional investors, further fueling demand.

- Diversification:

Investors can incorporate Bitcoin into their portfolios alongside traditional assets like stocks, bonds, and commodities. This diversification strategy aims to spread risk while capitalizing on Bitcoin’s potential upside.

In anticipation of soaring interest and adoption rates, let’s delve deeper into the key features that investors should consider when evaluating Bitcoin ETFs.

Key Features to Consider When Evaluating Bitcoin ETFs

When evaluating potential Bitcoin ETFs to invest in, it’s vital to understand the attributes that distinguish one fund from another. Each ETF comes with unique characteristics that cater to different investor needs and risk profiles.

Regulatory Compliance

One of the most crucial aspects of any Bitcoin ETF is its compliance with regulatory standards.

- Approval Process:

In the United States, the Securities and Exchange Commission (SEC) oversees the approval of Bitcoin ETFs. Funds that have gained SEC approval have undergone rigorous scrutiny, ensuring adherence to legal and operational standards. - Investor Protection:

Regulation serves to protect investors from fraud and market manipulation. An ETF that complies with regulatory requirements not only enhances credibility but also offers a layer of security against volatility. - Market Impact:

The level of regulatory acceptance can affect the ETF’s performance. Funds that quickly obtain regulatory approval often see a spike in investments, making it essential to stay updated on the latest developments.

Management and Expertise

A well-managed ETF can make a significant difference in its overall performance.

- Fund Management Team:

The experience and track record of the management team play a critical role in the success of the ETF. Look for teams with extensive backgrounds in finance, asset management, and cryptocurrency markets. - Operational Transparency:

Transparency regarding the fund’s operations, including fees, holdings, and strategies, is vital for gaining investor trust. Reputable ETFs publish regular reports detailing their performance and asset allocation. - Reputation:

The reputation of the managing firm can impact your decision. Established firms with proven historical performance in managing similar funds may present safer choices compared to newer or lesser-known entities.

Expense Ratios

While investing in ETFs generally has lower fees than mutual funds, expense ratios can differ widely among Bitcoin ETFs.

- Understanding Fees:

The expense ratio includes management fees, administrative costs, and other operational expenses. Higher expense ratios can erode returns over time, especially in a volatile asset class like Bitcoin. - Comparative Analysis:

When choosing between multiple ETFs, comparing their expense ratios is essential. A seemingly small difference in fees can accumulate significantly over the long term. - Hidden Costs:

Be aware of any additional costs associated with trading the ETF, such as brokerage commissions, bid-ask spreads, and tax implications. Thoroughly researching these factors can help you make an informed choice.

Performance Metrics

Analyzing past performance is a common practice when evaluating any investment.

- Historical Returns:

Review the ETF’s historical returns concerning Bitcoin’s price movements. While past performance does not guarantee future results, it provides insights into how the fund has reacted to market changes. - Volatility Assessment:

Given Bitcoin’s notorious volatility, understanding how the ETF has behaved during market swings is crucial. ETFs that efficiently mitigate downside risk during downturns may better suit conservative investors. - Risk-Adjusted Returns:

Consider assessing performance using risk-adjusted measures, such as the Sharpe ratio. This metric evaluates how much excess return is generated per unit of risk, helping to compare different investment options effectively.

By carefully considering these key features, investors can better position themselves to select the most suitable Bitcoin ETFs that align with their investment goals and tolerance for risk.

Top Performing Bitcoin ETFs of [Year]

As of [current year], several Bitcoin ETFs have emerged as top performers, leveraging the prevailing positive sentiment and growing market acceptance of Bitcoin. Let’s explore some of these standout offerings in detail.

Grayscale Bitcoin Trust (GBTC)

Grayscale Bitcoin Trust (GBTC) is among the most recognized investment vehicles for Bitcoin exposure, operating as a publicly traded trust that holds Bitcoin.

- Investment Structure:

Each share of GBTC represents a fraction of a Bitcoin, offering investors a way to invest indirectly in the asset. The trust is designed to track the price of Bitcoin closely, making it an attractive option for traditional investors. - Performance Overview:

Over the past few years, GBTC has delivered substantial returns, benefiting from Bitcoin’s bull runs. Still, its premium over net asset value (NAV) often raises concerns among investors regarding the true cost of holding the shares. - Market Reach:

With its established presence and significant assets under management, GBTC has become a bellwether for Bitcoin ETFs, attracting both retail and institutional investors.

ProShares Bitcoin Strategy ETF (BITO)

Launched in late 2021, ProShares Bitcoin Strategy ETF (BITO) was the first Bitcoin futures ETF approved by the SEC, generating considerable excitement within the investment community.

- Futures-Based Approach:

Unlike traditional Bitcoin ETFs that hold physical Bitcoin, BITO invests in Bitcoin futures contracts. This unique structure enables investors to gain exposure to Bitcoin’s price movements without owning the asset itself. - Market Demand:

The introduction of BITO marked a watershed moment for Bitcoin ETFs, broadening access for investors who prefer a more regulated approach. Its rapid accumulation of assets reflects strong market demand and investor interest. - Growth Potential:

As institutional interest in cryptocurrencies grows, BITO presents a promising opportunity for investors seeking diversified exposure to Bitcoin through a regulated product.

Valkyrie Bitcoin Strategy ETF (BTF)

Valkyrie Bitcoin Strategy ETF (BTF) is another futures-based ETF that entered the market shortly after BITO, providing investors with alternative exposure to Bitcoin.

- Investment Philosophy:

BTF aims to maximize returns through a combination of Bitcoin futures and active management strategies. The fund’s management team utilizes technical analysis to make decisions on contract positions, potentially optimizing returns. - Performance Metrics:

Although it is still relatively new, BTF has shown notable performance following its inception, benefiting from Bitcoin’s upward momentum. Additionally, its innovative investment strategy makes it worth keeping an eye on. - Investor Resources:

Valkyrie provides educational resources and tools to help investors navigate the complexities of Bitcoin investments. This commitment to investor education further solidifies its position in the market.

Bitwise 10 Crypto Index Fund (BITW)

For investors interested in broader cryptocurrency exposure beyond Bitcoin alone, Bitwise 10 Crypto Index Fund (BITW) offers a diversified portfolio of various digital assets.

- Portfolio Composition:

BITW holds a basket of the top ten cryptocurrencies by market capitalization, with Bitcoin representing the largest portion. This diversified approach allows investors to benefit from growth across multiple assets. - Long-Term Potential:

By investing in a mix of established cryptocurrencies, BITW aims to capture the overall growth potential of the digital asset class, while still providing significant exposure to Bitcoin. - Simplified Access:

Similar to traditional ETFs, BITW simplifies the process of investing in cryptocurrencies, allowing investors to access multiple assets without navigating numerous exchanges.

Each of these ETFs has distinct offerings, strengths, and market appeal. As the cryptocurrency landscape continues to evolve, keeping abreast of the performance of these funds is essential for investors seeking optimal exposure to Bitcoin.

Emerging Bitcoin ETFs: New Players in the Market

As the cryptocurrency space develops, new entrants continue to emerge, eager to capitalize on the burgeoning market for Bitcoin ETFs. These emerging ETFs introduce fresh perspectives and strategies, contributing to a more diverse investment landscape.

Amplify Transformational Data Sharing ETF (BLOK)

The Amplify Transformational Data Sharing ETF (BLOK) is an exciting addition to the realm of digital asset investing, focusing not just on Bitcoin but also on blockchain technology.

- Broad Exposure:

BLOK invests in companies involved in blockchain technology, digital currencies, and data sharing innovations. This unique angle allows investors to tap into the broader potential of the tech behind Bitcoin. - Innovation Focus:

Companies included in BLOK range from cryptocurrency miners to enterprises exploring decentralized solutions. This focus on innovation appeals to investors seeking exposure to the transformative potential of blockchain. - Performance Opportunities:

By diversifying investments across multiple sectors, BLOK can potentially deliver higher long-term returns, especially as blockchain technology gains traction across industries.

VanEck Bitcoin Strategy ETF (XBTF)

VanEck launched its Bitcoin Strategy ETF (XBTF), focusing on providing exposure to Bitcoin through a managed futures strategy.

- Strategic Approach:

XBTF employs an actively managed strategy, aiming to optimize risk and reward by dynamically allocating between Bitcoin futures and other asset classes. - Experienced Management Team:

Supported by a seasoned asset management firm, XBTF benefits from experienced professionals who monitor market conditions and adjust strategies accordingly. - Target Audience:

XBTF aims to attract both institutional and retail investors, catering to those who seek professional oversight when investing in Bitcoin.

Purpose Bitcoin ETF (BTCC)

Purpose Bitcoin ETF (BTCC) is Canada’s first Bitcoin ETF, paving the way for similar products in North America.

- Direct Holdings:

BTCC directly holds physical Bitcoin, allowing investors to own the underlying asset. This structure closely aligns with Bitcoin’s price movements and is appealing for those looking for tangible exposure. - Global Reach:

The launch of BTCC has inspired a wave of Bitcoin ETFs in Canada and beyond, reflecting growing global interest in regulated cryptocurrency products. - Management Efficiency:

Purpose Investments emphasizes efficient management practices, minimizing fees while maximizing investor returns, which is crucial in the competitive ETF landscape.

With various new players entering the market, investors must remain vigilant and informed about each fund’s unique value propositions and strategies. The continuous influx of emerging Bitcoin ETFs promises increased competition and innovation in the investment space.

Comparative Analysis: Fees, Holdings, and Performance

Investing in Bitcoin ETFs can involve complex considerations, particularly when selecting between various options available in the market. In this section, we’ll conduct a comparative analysis based on critical parameters: fees, holdings, and performance metrics, providing clarity to prospective investors.

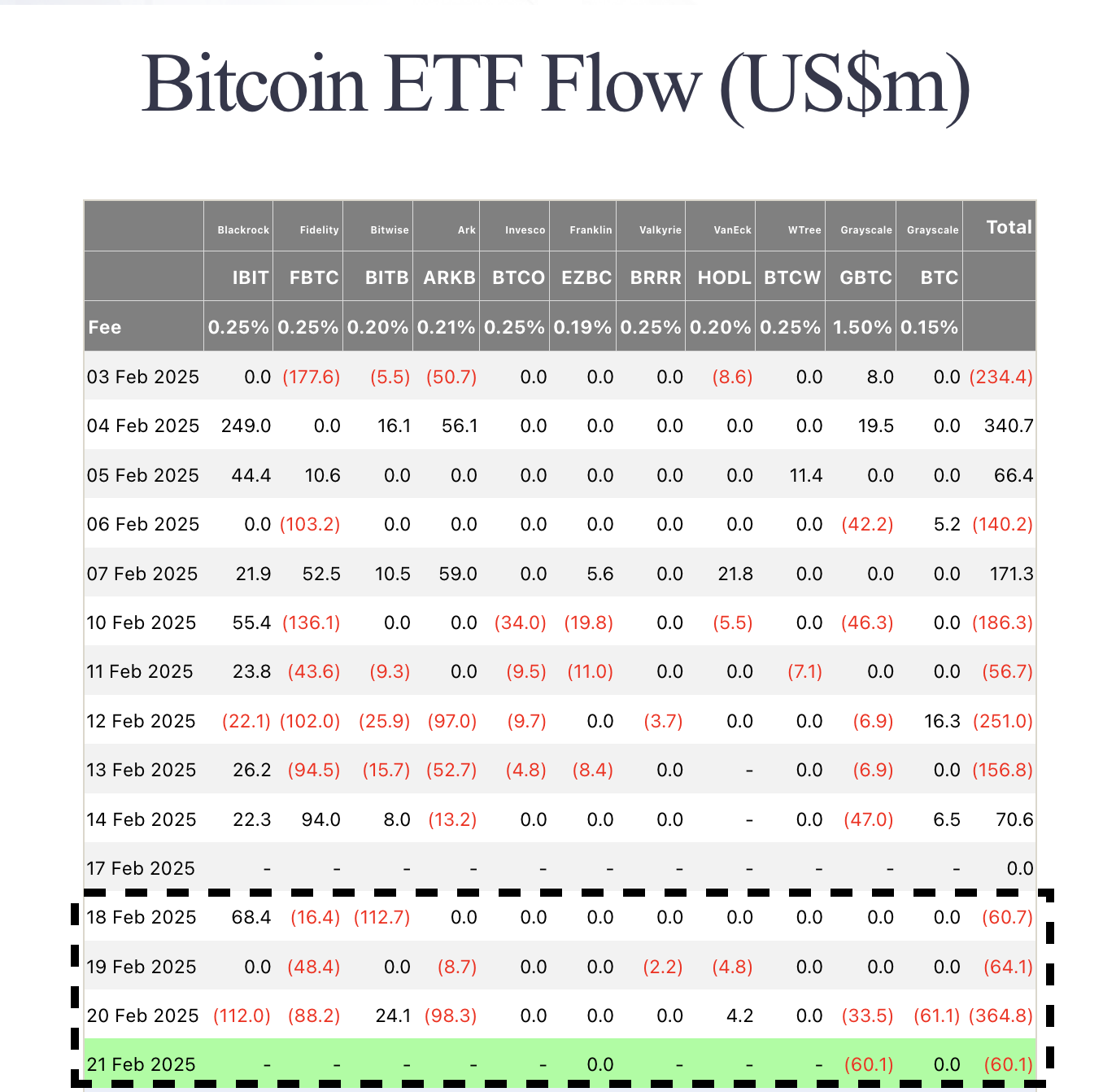

Analyzing Fees Across Bitcoin ETFs

Fees are an essential factor that can significantly influence the overall returns of an investment.

- Expense Ratios:

Different ETFs come with differing expense ratios. For example, traditional ETFs may charge around 0.5% to 1%, while Bitcoin ETFs might carry higher fees due to specialized management and regulatory compliance. A thorough examination of expense ratios is essential to ensure your chosen investment aligns with your financial goals. - Trading Costs:

Beyond the expense ratio, trading commissions and bid-ask spreads can affect the effective cost of investing in an ETF. It’s wise to evaluate the total cost of ownership rather than just the stated expense ratio. - Long-Term Implications:

Higher fees may lead to material differences in long-term returns, particularly in a volatile market like Bitcoin. Investors should weigh the potential benefits of a higher-cost fund against expected performance.

Holdings Comparison: Direct vs. Futures-Based ETFs

Another critical distinguishing factor among Bitcoin ETFs is their underlying holdings.

- Physical vs. Futures:

Some ETFs, like Grayscale Bitcoin Trust (GBTC) and Purpose Bitcoin ETF (BTCC), hold actual Bitcoin, while others, such as BITO and BTF, invest in Bitcoin futures contracts. Understanding the implications of each approach is crucial for assessing risk and potential return. - Asset Allocation:

A Bitcoin ETF that holds physical Bitcoin may behave differently from one based on futures contracts, particularly during periods of extreme market volatility. Assessing how each fund allocates its capital will inform risk appetite. - Diversification Options:

Some ETFs broaden their investment scope beyond Bitcoin to include other cryptocurrencies or blockchain-related assets. For example, BITW provides exposure to a basket of top cryptocurrencies, which may be beneficial for investors looking for diversification.

Performance Metrics: Historical Returns and Volatility

Evaluating historical performance metrics is integral to making informed investment decisions.

- Return Analysis:

Investors should analyze the historical returns of different ETFs relative to Bitcoin’s price movements. Comparing returns over various timeframes—short, medium, and long-term—can reveal insights into how funds react to changing market dynamics. - Volatility Measures:

Each ETF’s performance can vary significantly during periods of market turbulence. Understanding the volatility of a given fund is critical; a higher volatility may result in larger swings in value, impacting investor sentiment. - Risk-Adjusted Performance:

Utilizing risk-adjusted performance metrics such as the Sharpe ratio can help investors gauge how much return they are receiving for the level of risk taken. This measure provides clarity when comparing ETFs with varying levels of risk.

By examining fees, holdings, and performance metrics, investors can make more informed choices regarding which Bitcoin ETFs align best with their investment objectives and risk tolerance.

Investment Strategies and Risks Associated with Bitcoin ETFs

Investing in Bitcoin ETFs presents unique opportunities and challenges that require careful consideration. This section explores various investment strategies, as well as the associated risks that investors should be aware of before committing their capital.

Investment Strategies for Bitcoin ETFs

Developing a clear investment strategy is crucial for successfully navigating the Bitcoin ETF landscape.

- Buy-and-Hold Strategy:

One of the simplest approaches involves adopting a buy-and-hold strategy. Investors purchase shares of a Bitcoin ETF and hold them long-term, capitalizing on Bitcoin’s potential appreciation. This strategy is suitable for those who believe in the long-term viability of Bitcoin and wish to ride out short-term volatility. - Dollar-Cost Averaging:

Another popular method is dollar-cost averaging, where investors consistently buy a fixed dollar amount of the ETF at regular intervals. This strategy helps smooth out the effects of market volatility and reduces the impact of timing the market. - Tactical Allocation:

More active investors may opt for tactical allocation, where they adjust their holdings based on market conditions or macroeconomic indicators. This strategy requires a keen understanding of market trends and risks but can potentially enhance returns.

Risks Associated with Bitcoin ETFs

While Bitcoin ETFs present unique opportunities for investors, they also carry specific risks that must be understood.

- Market Volatility:

Bitcoin is notoriously volatile, and the prices can swing dramatically within short periods. As a result, Bitcoin ETFs are also subject to significant price fluctuations, which could lead to substantial losses for investors. - Regulatory Risks:

The regulatory environment surrounding cryptocurrencies is still evolving. Changes in regulations could impact the operation and profitability of Bitcoin ETFs. Investors must stay informed about potential legal developments that could affect their investments. - Operational Risks:

Each Bitcoin ETF has unique operational risks based on its management structure and investment strategy. For instance, funds relying on futures contracts may face additional complexities related to contract expirations and settlements.

Conclusion

In conclusion, Bitcoin ETFs offer a compelling avenue for investors seeking exposure to the dynamic world of cryptocurrencies while sidestepping some of the complexities associated with direct investment. Through a comprehensive understanding of the features of Bitcoin ETFs, their performance, emerging players in the market, and considerations related to fees, holdings, and investment strategies, investors can make informed decisions tailored to their individual risk appetites and investment objectives. Staying attuned to the rapidly evolving landscape will empower investors to seize opportunities in the ever-changing cryptocurrency environment.