Bitcoin vs Gold – Which Investment Holds Greater Value for Your Portfolio?

The debate surrounding Bitcoin vs gold as an investment has captured the attention of investors, financial analysts, and curious minds alike. Both assets have their unique characteristics, advantages, and drawbacks, making this discussion relevant in today’s economy where uncertainty reigns. In this blog post, we will explore both assets in detail, examining their historical performance, volatility, risk factors, inflation hedging properties, market drivers, and how they can complement each other in a diversified portfolio.

Bitcoin vs. Gold: A Comparative Investment Analysis

When it comes to investing, gold has long been revered as a safe haven asset, while Bitcoin is often seen as a revolutionary digital currency that holds the potential for high returns. Understanding each asset’s inherent value requires a comprehensive look at their origins, development, and current market dynamics.

As we delve into this comparative analysis, it becomes essential to assess various perspectives, including historical trends, economic implications, and the evolving nature of investment strategies.

Historical Significance and Development

Gold has been utilized as a form of currency and a store of value for thousands of years. From ancient Egypt to modern economies, gold has maintained its allure due to its intrinsic properties—rarity, durability, divisibility, and fungibility. Its role as a hedge against inflation, as well as a reliable means of wealth preservation, has solidified its status over centuries.

Bitcoin, on the other hand, emerged just over a decade ago, introduced by an anonymous entity known as Satoshi Nakamoto in 2009. Initially designed as a decentralized digital currency, Bitcoin has since evolved into a speculative asset class. Its limited supply of 21 million coins lends itself to a unique scarcity that mimics the qualities of precious metals like gold.

Evolution of Market Perception

Over the years, the perception of both assets has shifted dramatically. While gold traditionally attracted conservative investors seeking stability, Bitcoin’s emergence sparked the interest of tech-savvy, younger demographics looking for alternative investments.

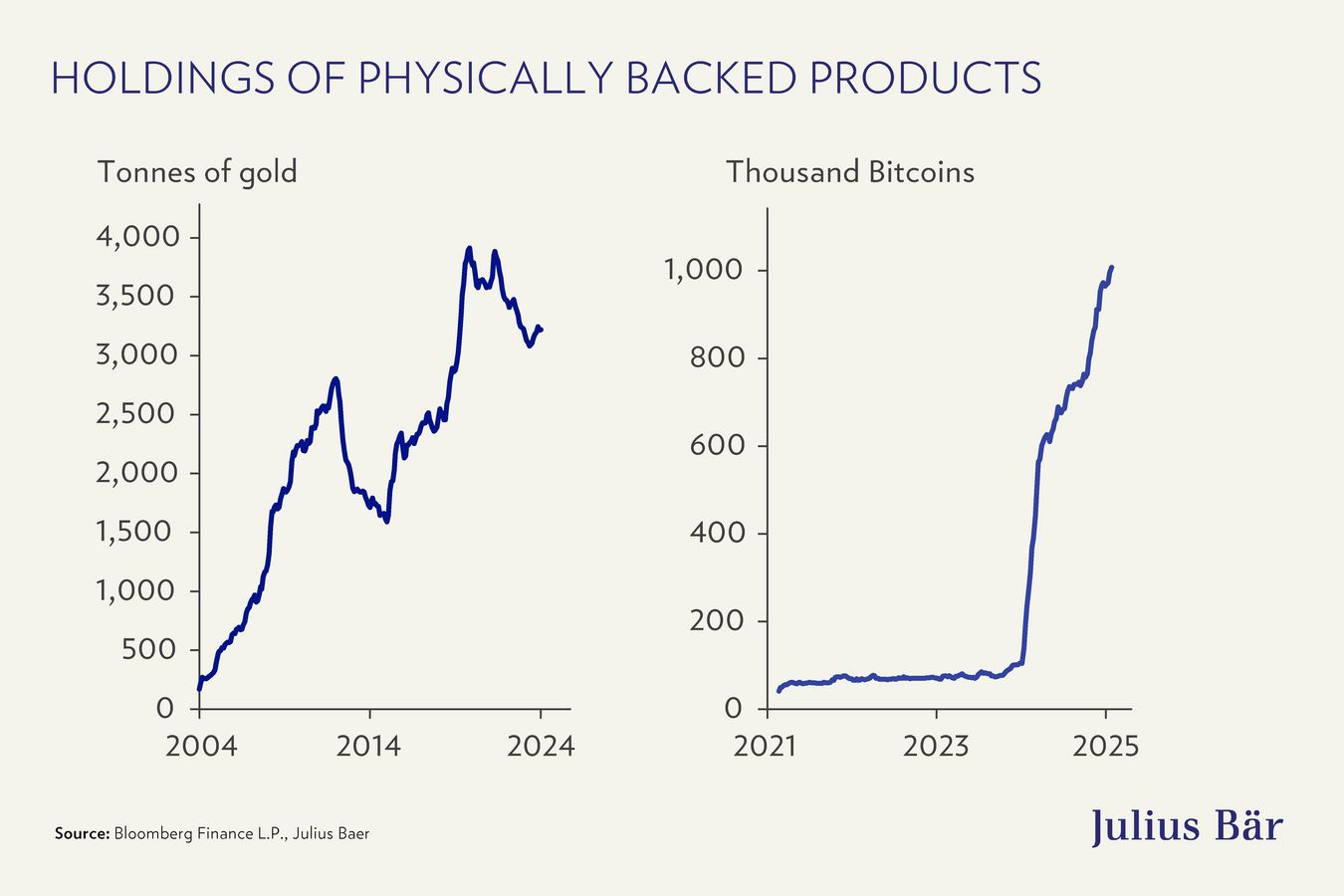

Bitcoin’s allure stems from its decentralized nature and blockchain technology, which enables peer-to-peer transactions without the need for intermediaries. This transformation has led to increased adoption, with more institutional players entering the space, thereby legitimizing it in the eyes of traditional investors.

Conversely, gold remains a tangible asset, often perceived as a more stable investment during turbulent times. The historical context behind gold provides a sense of security, particularly among risk-averse individuals.

Historical Performance: Bitcoin and Gold in Review

To evaluate Bitcoin vs gold as an investment, we must analyze their historical performances. This evaluation not only sheds light on short-term price fluctuations but also indicates long-term trends and growth potentials.

Long-Term Price Trends

Historically, gold has demonstrated a steady increase in value over the long term. Despite experiencing volatility through economic cycles, gold prices have generally risen in response to inflationary pressures or geopolitical tensions.

On the flip side, Bitcoin’s price trajectory has been far more erratic since its inception. Following several boom-and-bust cycles, Bitcoin reached unprecedented heights in late 2020 and early 2021, pushing its price close to $60,000 before experiencing substantial corrections.

Comparative Returns

When considering returns, Bitcoin vastly outperformed gold during its formative years. For example, between January 2012 and December 2020, Bitcoin experienced exponential growth, translating into returns exceeding 1,000%. Conversely, gold appreciated at a much slower rate, offering returns of around 60% during the same period.

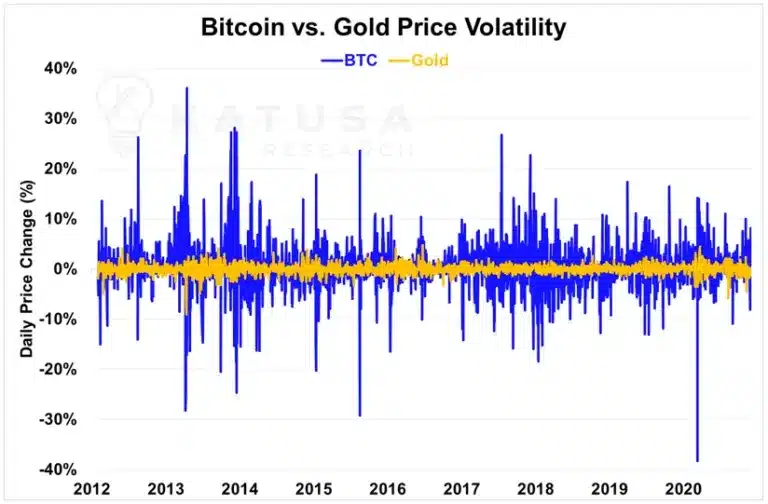

Despite Bitcoin’s impressive return profile, its volatility remains an inherent challenge. The extreme price swings observed in cryptocurrency markets are significantly greater than those typically found in gold markets, presenting both opportunities and risks for investors.

Resilience During Economic Downturns

During periods of economic uncertainty, gold has consistently proven its worth as a protective asset. For instance, during the 2008 financial crisis, gold prices soared as investors flocked to safer havens.

In contrast, Bitcoin’s resilience during economic downturns is still being tested. Although some proponents argue that Bitcoin serves as “digital gold,” its behavior during crises has yet to be thoroughly validated. Consequently, investors should approach Bitcoin with caution during economic turbulence.

Volatility and Risk: Understanding the Differences Between Bitcoin and Gold

Both Bitcoin and gold exhibit unique levels of volatility and associated risks. Gaining insight into these differences is crucial for investors who seek to understand the underlying dynamics that drive each asset’s price movements.

Nature of Price Movements

Gold is often viewed as a stable asset with relatively predictable price fluctuations. Factors such as central bank policies, changes in global demand, and supply constraints from mining operations can affect gold prices, but they tend to move gradually over time.

Bitcoin, however, operates in a vastly different environment marked by rapid technological change and speculative trading. Prices can surge or plummet within hours based on market sentiment, regulatory announcements, or macroeconomic events. Such spikes create an inherently risky investment landscape.

Risks Associated with Each Asset

Investing in gold carries risks primarily related to market supply and demand dynamics, geopolitical instability, and changing investor preferences. However, these risks are generally moderated by gold’s established history and status as a traditional asset.

In contrast, Bitcoin is exposed to a myriad of risks, including:

- Regulatory scrutiny and legal challenges

- Security vulnerabilities (e.g., hacks, thefts)

- Market manipulation and fraud

This heightened level of risk may deter conservative investors who prefer the stability of traditional assets like gold.

Mitigating Volatility Through Timing Strategies

For investors aiming to navigate the rollercoaster ride of Bitcoin, timing strategies can prove beneficial. By identifying favorable entry and exit points, investors can capitalize on price disparities. Moreover, utilizing stop-loss orders and moving averages can help manage risks associated with sudden downturns.

Conversely, gold may require less aggressive timing strategies, given its inherent stability. Investors can afford to adopt a buy-and-hold approach, allowing them to ride out short-term fluctuations while benefiting from gold’s long-term appreciation.

Store of Value: Examining Bitcoin and Gold’s Inflation Hedging Properties

A critical aspect of any investment is its ability to serve as a store of value, especially in times of economic distress and inflation. As we compare Bitcoin vs gold as an investment, it is essential to examine how each asset performs in this regard.

Long-standing Reputation of Gold

Gold has historically been regarded as a premier store of value. Its finite supply, coupled with rising demand from industries such as jewelry and electronics, positions gold as an effective hedge against inflation. When currency values decline, gold typically appreciates, thereby safeguarding wealth.

Additionally, during periods of monetary expansion, when central banks inject capital into the economy, gold has proven resilient. Investors often turn to gold as a safeguard against currency devaluation, enhancing its reputation as a reliable store of value.

Bitcoin’s Emerging Role as Digital Gold

Bitcoin’s narrative as “digital gold” is gaining traction as a potential hedge against inflation. Limited supply—capped at 21 million coins—mirrors the scarcity of gold, suggesting that Bitcoin could maintain value over time.

However, Bitcoin’s performance in periods of inflation remains debatable. While it surged during times of increased money supply, it also exhibited extreme volatility. Critics argue that until Bitcoin achieves consistent stability and widespread acceptance, it cannot fully replace gold as a hedge against inflation.

The Evolving Investment Landscape

The evolving financial landscape presents unique opportunities for both assets. Investors now have the option to diversify their portfolios, incorporating Bitcoin alongside gold, thus creating a blend of traditional and innovative investments that may offer complementary benefits.

In this context, understanding how each asset fits into an overall investment strategy becomes paramount. With inflation concerns looming large, investors might consider holding both assets to leverage their respective strengths.

Market Factors: Key Drivers Influencing Bitcoin and Gold Prices

Understanding the market factors that influence Bitcoin vs gold as an investment is essential for successful navigation of the investment landscape. Analyzing these drivers can equip investors with the insights needed to make informed decisions.

Macroeconomic Indicators

Various macroeconomic indicators play a significant role in determining gold and Bitcoin prices. Interest rates, inflation rates, and GDP growth figures directly impact demand for both assets. Generally, low-interest rates encourage investment in gold and cryptocurrencies, while higher rates may prompt shifts to fixed-income assets.

Additionally, inflation expectations heavily influence gold purchases as investors seek to protect their purchasing power. Similarly, escalating inflation can boost Bitcoin’s appeal among those desiring a hedge against currency depreciation.

Geopolitical Events

Geopolitical tensions often lead to heightened uncertainty in financial markets, prompting investors to seek safe-haven assets. Gold prices typically rise in response to political instability, military conflicts, or economic sanctions, as investors abandon riskier assets.

Conversely, Bitcoin’s reaction to geopolitical events has yet to reach consistency. While it may initially respond positively to uncertainty, its susceptibility to broader market sentiment makes it challenging to predict how Bitcoin will react in similar situations.

Regulatory Developments

Regulatory frameworks surrounding cryptocurrencies remain fluid, leading to impacts on Bitcoin prices. News of government crackdowns, proposed regulations, or endorsements can cause rapid fluctuations in Bitcoin’s value.

In contrast, gold enjoys a more stable regulatory environment, having resided in a well-established framework for centuries. While regulations may influence gold prices—such as tariffs or mining restrictions—they tend to do so in a less volatile manner compared to Bitcoin.

Portfolio Diversification: Incorporating Bitcoin and Gold into an Investment Strategy

Incorporating both gold and Bitcoin in an investment strategy offers unique diversification opportunities. By understanding the strengths and weaknesses of each asset, investors can craft a balanced portfolio that aligns with their risk tolerance and long-term goals.

Assessing Risk Tolerance

Before committing to any investment strategy, assessing risk tolerance is paramount. Some investors may prioritize stability and wealth preservation, gravitating towards gold’s historical reliability. In contrast, others may embrace the potential upside of Bitcoin, ready to accept its volatility in pursuit of extraordinary returns.

A balanced approach recognizes that risk tolerance isn’t static; it can evolve over time. As investors gain experience and knowledge, they may choose to adjust their allocations accordingly.

Strategic Asset Allocation

Strategic asset allocation involves determining the proportion of an investment portfolio dedicated to each asset class. For instance, a conservative investor might opt for a larger allocation to gold, securing wealth and minimizing risks, while allocating a smaller portion to Bitcoin for potential growth.

Conversely, a more aggressive investor may lean heavily toward Bitcoin, viewing it as a high-risk, high-reward asset. Regardless of the chosen allocation model, regularly reviewing and rebalancing the portfolio ensures alignment with evolving market conditions and personal objectives.

Keeping Abreast of Market Trends

Staying informed about market trends is vital for maximizing investment outcomes. This includes monitoring developments in economic indicators, geopolitical events, and regulatory updates that may impact both gold and Bitcoin.

Investors should establish routines for research, utilizing resources such as financial news outlets, investment forums, and expert analyses to stay ahead of market dynamics. Continuous education enhances decision-making capabilities, empowering investors to adapt their strategies as necessary.

Conclusion

The discussion pertaining to Bitcoin vs gold as an investment remains one of the most compelling topics in financial circles today. Both assets offer distinct advantages and pose unique risks, providing investors with opportunities for diversification and wealth preservation. By analyzing their historical performances, volatility, inflation hedging capabilities, and market factors, investors can develop prudent strategies that align with their financial goals. The key lies in understanding that neither asset is a definitive replacement for the other; rather, they can coexist in a well-balanced portfolio, each contributing to a broader investment narrative in an ever-evolving financial landscape.